European debt crisis facts for kids

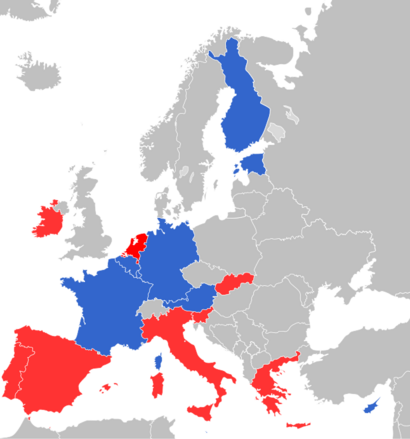

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, was a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone member states (Greece, Portugal, Ireland, Spain, and Cyprus) were unable to repay or refinance their government debt or to bail out over-indebted banks under their national supervision without the assistance of third parties like other eurozone countries, the European Central Bank (ECB), or the International Monetary Fund (IMF).

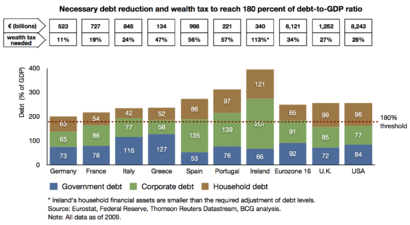

The eurozone crisis was caused by a balance-of-payments crisis, which is a sudden stop of the flow of foreign capital into countries that had substantial deficits and were dependent on foreign lending. The crisis was worsened by the inability of states to resort to devaluation (reductions in the value of the national currency) due to having the Euro as a shared currency. Debt accumulation in some eurozone members was in part due to macroeconomic differences among eurozone member states prior to the adoption of the euro. The European Central Bank adopted an interest rate that incentivized investors in Northern eurozone members to lend to the South, whereas the South was incentivized to borrow because interest rates were very low. Over time, this led to the accumulation of deficits in the South, primarily by private economic actors. A lack of fiscal policy coordination among eurozone member states contributed to imbalanced capital flows in the eurozone, while a lack of financial regulatory centralization or harmonization among eurozone states, coupled with a lack of credible commitments to provide bailouts to banks, incentivized risky financial transactions by banks. The detailed causes of the crisis varied from country to country. In several countries, private debts arising from a property bubble were transferred to sovereign debt as a result of banking system bailouts and government responses to slowing economies post-bubble. European banks own a significant amount of sovereign debt, such that concerns regarding the solvency of banking systems or sovereigns are negatively reinforcing.

The onset of crisis was in late 2009 when the Greek government disclosed that its budget deficits were far higher than previously thought. Greece called for external help in early 2010, receiving an EU–IMF bailout package in May 2010. European nations implemented a series of financial support measures such as the European Financial Stability Facility (EFSF) in early 2010 and the European Stability Mechanism (ESM) in late 2010. The ECB also contributed to solve the crisis by lowering interest rates and providing cheap loans of more than one trillion euro in order to maintain money flows between European banks. On 6 September 2012, the ECB calmed financial markets by announcing free unlimited support for all eurozone countries involved in a sovereign state bailout/precautionary programme from EFSF/ESM, through some yield lowering Outright Monetary Transactions (OMT). Ireland and Portugal received EU-IMF bailouts In November 2010 and May 2011, respectively. In March 2012, Greece received its second bailout. Both Spain and Cyprus received rescue packages in June 2012.

Return to economic growth and improved structural deficits enabled Ireland and Portugal to exit their bailout programmes in July 2014. Greece and Cyprus both managed to partly regain market access in 2014. Spain never officially received a bailout programme. Its rescue package from the ESM was earmarked for a bank recapitalisation fund and did not include financial support for the government itself. The crisis has had significant adverse economic effects and labour market effects, with unemployment rates in Greece and Spain reaching 27%, and was blamed for subdued economic growth, not only for the entire eurozone but for the entire European Union. It had a major political impact on the ruling governments in 10 out of 19 eurozone countries, contributing to power shifts in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, Belgium, and the Netherlands as well as outside of the eurozone in the United Kingdom.

Contents

Causes

The eurozone crisis resulted from the structural problem of the eurozone and a combination of complex factors. There is a consensus that the root of the eurozone crisis lay in a balance-of-payments crisis (a sudden stop of foreign capital into countries that were dependent on foreign lending), and that this crisis was worsened by the fact that states could not resort to devaluation (reductions in the value of the national currency to make exports more competitive in foreign markets). Other important factors include the globalisation of finance; easy credit conditions during the 2002–2008 period that encouraged high-risk lending and borrowing practices; the financial crisis of 2007–08; international trade imbalances; real estate bubbles that have since burst; the Great Recession of 2008–2012; fiscal policy choices related to government revenues and expenses; and approaches used by states to bail out troubled banking industries and private bondholders, assuming private debt burdens or socializing losses.

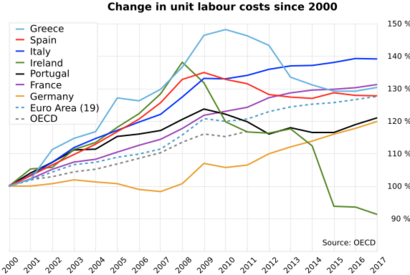

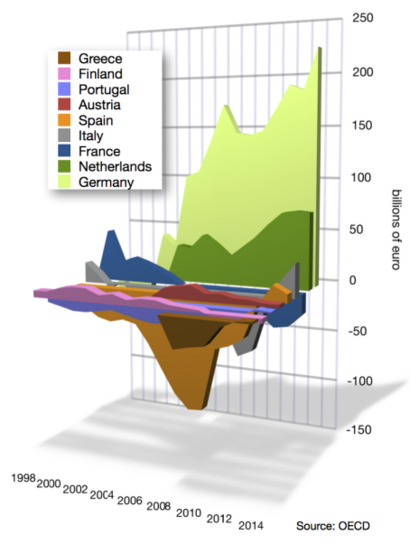

Macroeconomic divergence among eurozone member states led to imbalanced capital flows between the member states. Despite different macroeconomic conditions, the European Central Bank could only adopt one interest rate, choosing one that meant that real interest rates in Germany were high (relative to inflation) and low in Southern eurozone member states. This incentivized investors in Germany to lend to the South, whereas the South was incentivized to borrow (because interest rates were very low). Over time, this led to the accumulation of deficits in the South, primarily by private economic actors.

Comparative political economy explains the fundamental roots of the European crisis in varieties of national institutional structures of member countries (north vs. south), which conditioned their asymmetric development trends over time and made the union susceptible to external shocks. Imperfections in the Eurozone's governance construction to react effectively exacerbated macroeconomic divergence.

Eurozone member states could have alleviated the imbalances in capital flows and debt accumulation in the South by coordinating national fiscal policies. Germany could have adopted more expansionary fiscal policies (to boost domestic demand and reduce the outflow of capital) and Southern eurozone member states could have adopted more restrictive fiscal policies (to curtail domestic demand and reduce borrowing from the North). Per the requirements of the 1992 Maastricht Treaty, governments pledged to limit their deficit spending and debt levels. However, some of the signatories, including Germany and France, failed to stay within the confines of the Maastricht criteria and turned to securitising future government revenues to reduce their debts and/or deficits, sidestepping best practice and ignoring international standards. This allowed the sovereigns to mask their deficit and debt levels through a combination of techniques, including inconsistent accounting, off-balance-sheet transactions, and the use of complex currency and credit derivatives structures. From late 2009 on, after Greece's newly elected, PASOK government stopped masking its true indebtedness and budget deficit, fears of sovereign defaults in certain European states developed in the public, and the government debt of several states was downgraded. The crisis subsequently spread to Ireland and Portugal, while raising concerns about Italy, Spain, and the European banking system, and more fundamental imbalances within the eurozone. The under-reporting was exposed through a revision of the forecast for the 2009 budget deficit from "6–8%" of GDP (no greater than 3% of GDP was a rule of the Maastricht Treaty) to 12.7%, almost immediately after PASOK won the October 2009 Greek national elections. Large upwards revision of budget deficit forecasts due to the international financial crisis were not limited to Greece: for example, in the United States forecast for the 2009 budget deficit was raised from $407 billion projected in the 2009 fiscal year budget, to $1.4 trillion, while in the United Kingdom there was a final forecast more than 4 times higher than the original. In Greece, the low ("6–8%") forecast was reported until very late in the year (September 2009), clearly not corresponding to the actual situation.

Fragmented financial regulation contributed to irresponsible lending in the years prior to the crisis. In the eurozone, each country had its own financial regulations, which allowed financial institutions to exploit gaps in monitoring and regulatory responsibility to resort to loans that were high-yield but very risky. Harmonization or centralization in financial regulations could have alleviated the problem of risky loans. Another factor that incentivized risky financial transaction was that national governments could not credibly commit not to bailout financial institutions who had undertaken risky loans, thus causing a moral hazard problem. The Eurozone can incentivize overborrowing through a tragedy of the commons.

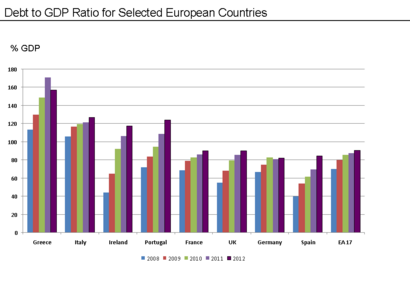

Evolution of the crisis

The European debt crisis erupted in the wake of the Great Recession around late 2009, and was characterized by an environment of overly high government structural deficits and accelerating debt levels. When, as a negative repercussion of the Great Recession, the relatively fragile banking sector had suffered large capital losses, most states in Europe had to bail out several of their most affected banks with some supporting recapitalization loans, because of the strong linkage between their survival and the financial stability of the economy. As of January 2009, a group of 10 central and eastern European banks had already asked for a bailout. At the time, the European Commission released a forecast of a 1.8% decline in EU economic output for 2009, making the outlook for the banks even worse. The many public funded bank recapitalizations were one reason behind the sharply deteriorated debt-to-GDP ratios experienced by several European governments in the wake of the Great Recession. The main root causes for the four sovereign debt crises erupting in Europe were reportedly a mix of: weak actual and potential growth; competitive weakness; liquidation of banks and sovereigns; large pre-existing debt-to-GDP ratios; and considerable liability stocks (government, private, and non-private sector).

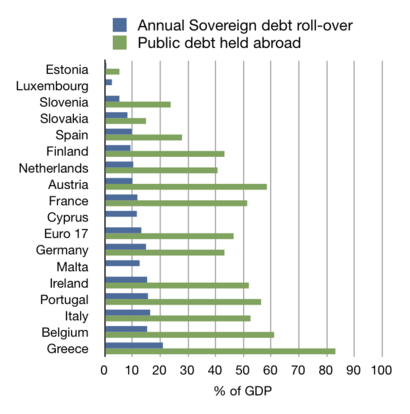

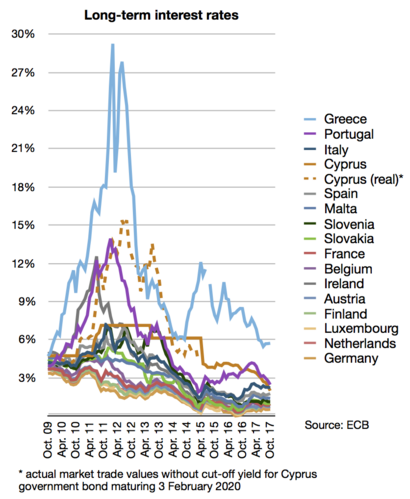

In the first few weeks of 2010, there was renewed anxiety about excessive national debt, with lenders demanding ever-higher interest rates from several countries with higher debt levels, deficits, and current account deficits. This in turn made it difficult for four out of eighteen eurozone governments to finance further budget deficits and repay or refinance existing government debt, particularly when economic growth rates were low, and when a high percentage of debt was in the hands of foreign creditors, as in the case of Greece and Portugal.

The states that were adversely affected by the crisis faced a strong rise in interest rate spreads for government bonds as a result of investor concerns about their future debt sustainability. Four eurozone states had to be rescued by sovereign bailout programs, which were provided jointly by the International Monetary Fund and the European Commission, with additional support at the technical level from the European Central Bank. Together these three international organisations representing the bailout creditors became nicknamed "the Troika".

To fight the crisis some governments have focused on raising taxes and lowering expenditures, which contributed to social unrest and significant debate among economists, many of whom advocate greater deficits when economies are struggling. Especially in countries where budget deficits and sovereign debts have increased sharply, a crisis of confidence has emerged with the widening of bond yield spreads and risk insurance on CDS between these countries and other EU member states, most importantly Germany. By the end of 2011, Germany was estimated to have made more than €9 billion out of the crisis as investors flocked to safer but near zero interest rate German federal government bonds (bunds). By July 2012 also the Netherlands, Austria, and Finland benefited from zero or negative interest rates. Looking at short-term government bonds with a maturity of less than one year the list of beneficiaries also includes Belgium and France. While Switzerland (and Denmark) equally benefited from lower interest rates, the crisis also harmed its export sector due to a substantial influx of foreign capital and the resulting rise of the Swiss franc. In September 2011 the Swiss National Bank surprised currency traders by pledging that "it will no longer tolerate a euro-franc exchange rate below the minimum rate of 1.20 francs", effectively weakening the Swiss franc. This is the biggest Swiss intervention since 1978.

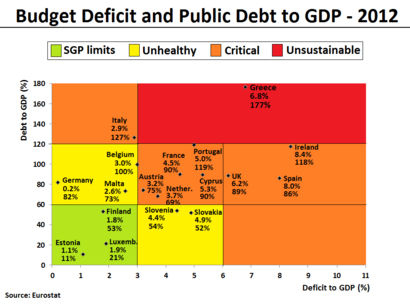

Despite sovereign debt having risen substantially in only a few eurozone countries, with the three most affected countries Greece, Ireland and Portugal collectively only accounting for 6% of the eurozone's gross domestic product (GDP), it became a perceived problem for the area as a whole, leading to concerns about further contagion of other European countries and a possible break-up of the eurozone. In total, the debt crisis forced five out of 17 eurozone countries to seek help from other nations by the end of 2012.

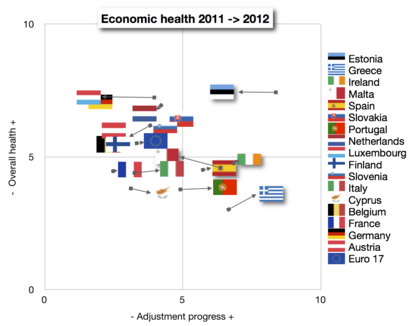

In mid-2012, due to successful fiscal consolidation and implementation of structural reforms in the countries being most at risk and various policy measures taken by EU leaders and the ECB (see below), financial stability in the eurozone improved significantly and interest rates fell steadily. This also greatly diminished contagion risk for other eurozone countries. As of October 2012[update] only 3 out of 17 eurozone countries, namely Greece, Portugal, and Cyprus still battled with long-term interest rates above 6%. By early January 2013, successful sovereign debt auctions across the eurozone but most importantly in Ireland, Spain, and Portugal, showed investors' confidence in the ECB backstop. In November 2013 ECB lowered its bank rate to only 0.25% to aid recovery in the eurozone. As of May 2014 only two countries (Greece and Cyprus) still needed help from third parties.

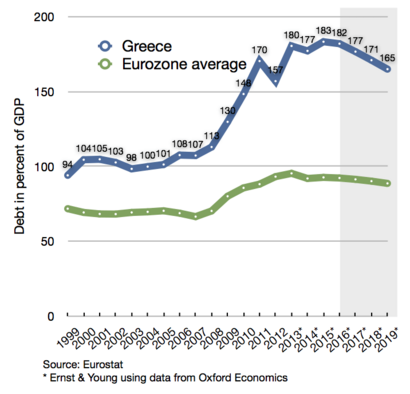

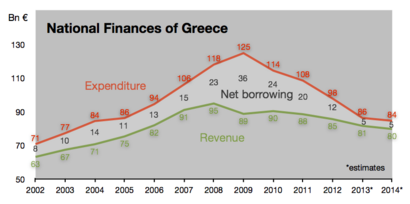

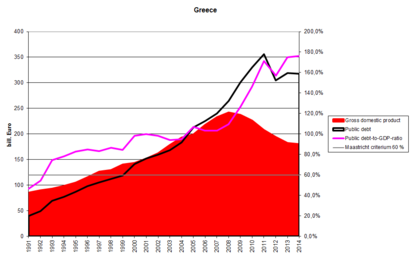

Greece

The Greek economy had fared well for much of the 20th century, with high growth rates and low public debt. By 2007 (i.e., before the global financial crisis of 2007–2008), it was still one of the fastest growing in the eurozone, with a public debt-to-GDP that did not exceed 104%, but it was associated with a large structural deficit. As the world economy was hit by the financial crisis of 2007–08, Greece was hit especially hard because its main industries—shipping and tourism—were especially sensitive to changes in the business cycle. The government spent heavily to keep the economy functioning and the country's debt increased accordingly.

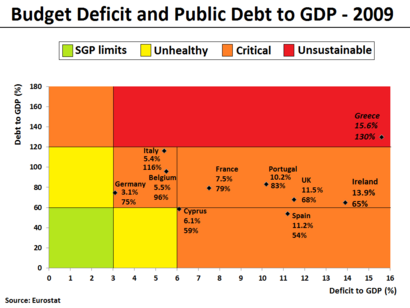

The Greek crisis was triggered by the turmoil of the Great Recession, which led the budget deficits of several Western nations to reach or exceed 10% of GDP. In the case of Greece, the high budget deficit (which, after several corrections, had been allowed to reach 10.2% and 15.1% of GDP in 2008 and 2009, respectively) was coupled with a high public debt to GDP ratio (which, until then, was relatively stable for several years, at just above 100% of GDP, as calculated after all corrections). Thus, the country appeared to lose control of its public debt to GDP ratio, which already reached 127% of GDP in 2009. In contrast, Italy was able (despite the crisis) to keep its 2009 budget deficit at 5.1% of GDP, which was crucial, given that it had a public debt to GDP ratio comparable to Greece's. In addition, being a member of the Eurozone, Greece had essentially no autonomous monetary policy flexibility.

Finally, there was an effect of controversies about Greek statistics (due the aforementioned drastic budget deficit revisions which led to an increase in the calculated value of the Greek public debt by about 10%, a public debt-to-GDP ratio of about 100% until 2007), while there have been arguments about a possible effect of media reports. Consequently, Greece was "punished" by the markets which increased borrowing rates, making it impossible for the country to finance its debt since early 2010.

Despite the drastic upwards revision of the forecast for the 2009 budget deficit in October 2009, Greek borrowing rates initially rose rather slowly. By April 2010 it was apparent that the country was becoming unable to borrow from the markets; on 23 April 2010, the Greek government requested an initial loan of €45 billion from the EU and International Monetary Fund (IMF) to cover its financial needs for the remaining part of 2010. A few days later Standard & Poor's slashed Greece's sovereign debt rating to BB+ or "junk" status amid fears of default, in which case investors were liable to lose 30–50% of their money. Stock markets worldwide and the euro currency declined in response to the downgrade.

On 1 May 2010, the Greek government announced a series of austerity measures (the third austerity package within months) to secure a three-year €110 billion loan (First Economic Adjustment Programme). This was met with great anger by some Greeks, leading to massive protests, riots, and social unrest throughout Greece. The Troika, a tripartite committee formed by the European Commission, the European Central Bank and the International Monetary Fund (EC, ECB and IMF), offered Greece a second bailout loan worth €130 billion in October 2011 (Second Economic Adjustment Programme), but with the activation being conditional on implementation of further austerity measures and a debt restructure agreement. Surprisingly, the Greek prime minister George Papandreou first answered that call by announcing a December 2011 referendum on the new bailout plan, but had to back down amidst strong pressure from EU partners, who threatened to withhold an overdue €6 billion loan payment that Greece needed by mid-December. On 10 November 2011, Papandreou resigned following an agreement with the New Democracy party and the Popular Orthodox Rally to appoint non-MP technocrat Lucas Papademos as new prime minister of an interim national union government, with responsibility for implementing the needed austerity measures to pave the way for the second bailout loan.

All the implemented austerity measures have helped Greece bring down its primary deficit—i.e., fiscal deficit before interest payments—from €24.7bn (10.6% of GDP) in 2009 to just €5.2bn (2.4% of GDP) in 2011, but as a side-effect they also contributed to a worsening of the Greek recession, which began in October 2008 and only became worse in 2010 and 2011. The Greek GDP had its worst decline in 2011 with −6.9%, a year where the seasonal adjusted industrial output ended 28.4% lower than in 2005, and with 111,000 Greek companies going bankrupt (27% higher than in 2010). As a result, Greeks have lost about 40% of their purchasing power since the start of the crisis, they spend 40% less on goods and services, and the seasonal adjusted unemployment rate grew from 7.5% in September 2008 to a record high of 27.9% in June 2013, while the youth unemployment rate rose from 22.0% to as high as 62%. Youth unemployment ratio hit 16.1 per cent in 2012.

Overall the share of the population living at "risk of poverty or social exclusion" did not increase notably during the first two years of the crisis. The figure was measured to 27.6% in 2009 and 27.7% in 2010 (only being slightly worse than the EU27-average at 23.4%), but for 2011 the figure was now estimated to have risen sharply above 33%. In February 2012, an IMF official negotiating Greek austerity measures admitted that excessive spending cuts were harming Greece. The IMF predicted the Greek economy to contract by 5.5% by 2014. Harsh austerity measures led to an actual contraction after six years of recession of 17%.

Some economic experts argue that the best option for Greece, and the rest of the EU, would be to engineer an "orderly default", allowing Athens to withdraw simultaneously from the eurozone and reintroduce its national currency the drachma at a debased rate. If Greece were to leave the euro, the economic and political consequences would be devastating. According to Japanese financial company Nomura an exit would lead to a 60% devaluation of the new drachma. Analysts at French bank BNP Paribas added that the fallout from a Greek exit would wipe 20% off Greece's GDP, increase Greece's debt-to-GDP ratio to over 200%, and send inflation soaring to 40–50%. Also UBS warned of hyperinflation, a bank run and even "military coups and possible civil war that could afflict a departing country". Eurozone National Central Banks (NCBs) may lose up to €100bn in debt claims against the Greek national bank through the ECB's TARGET2 system. The Deutsche Bundesbank alone may have to write off €27bn.

To prevent this from happening, the Troika (EC, IMF and ECB) eventually agreed in February 2012 to provide a second bailout package worth €130 billion, conditional on the implementation of another harsh austerity package that would reduce Greek expenditure by €3.3bn in 2012 and another €10bn in 2013 and 2014.

Then, in March 2012, the Greek government did finally default on parts of its debt - as there was a new law passed by the government so that private holders of Greek government bonds (banks, insurers and investment funds) would "voluntarily" accept a bond swap with a 53.5% nominal write-off, partly in short-term EFSF notes, partly in new Greek bonds with lower interest rates and the maturity prolonged to 11–30 years (independently of the previous maturity). This counted as a "credit event" and holders of credit default swaps were paid accordingly. It was the world's biggest debt restructuring deal ever done, affecting some €206 billion of Greek government bonds. The debt write-off had a size of €107 billion, and caused the Greek debt level to temporarily fall from roughly €350bn to €240bn in March 2012 (it would subsequently rise again, due to the resulting bank recapitalization needs), with improved predictions about the debt burden. In December 2012, the Greek government bought back €21 billion ($27 billion) of their bonds for 33 cents on the euro.

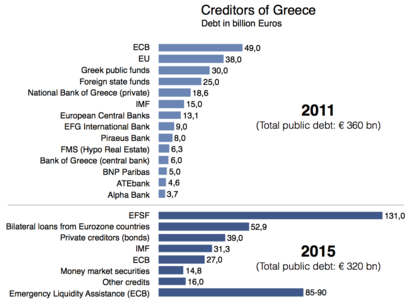

Critics such as the director of LSE's Hellenic Observatory argue that the billions of taxpayer euros are not saving Greece but financial institutions. Of all €252bn in bailouts between 2010 and 2015, just 10% has found its way into financing continued public deficit spending on the Greek government accounts. Much of the rest went straight into refinancing the old stock of Greek government debt (originating mainly from the high general government deficits being run in previous years), which was mainly held by private banks and hedge funds by the end of 2009. According to LSE, "more than 80% of the rescue package" is going to refinance the expensive old maturing Greek government debt towards private creditors (mainly private banks outside Greece), replacing it with new debt to public creditors on more favourable terms, that is to say paying out their private creditors with new debt issued by its new group of public creditors known as the Troika.

The shift in liabilities from European banks to European taxpayers has been staggering. One study found that the public debt of Greece to foreign governments, including debt to the EU/IMF loan facility and debt through the Eurosystem, increased from €47.8bn to €180.5bn (+132,7bn) between January 2010 and September 2011, while the combined exposure of foreign banks to (public and private) Greek entities was reduced from well over €200bn in 2009 to around €80bn (−€120bn) by mid-February 2012. As of 2015[update], 78% of Greek debt is owed to public sector institutions, primarily the EU. According to a study by the European School of Management and Technology only €9.7bn or less than 5% of the first two bailout programs went to the Greek fiscal budget, while most of the money went to French and German banks (In June 2010, France's and Germany's foreign claims vis-a-vis Greece were $57bn and $31bn respectively. German banks owned $60bn of Greek, Portuguese, Irish and Spanish government debt and $151bn of banks' debt of these countries).

According to a leaked document, dated May 2010, the IMF was fully aware of the fact that the Greek bailout program was aimed at rescuing the private European banks – mainly from France and Germany. A number of IMF Executive Board members from India, Brazil, Argentina, Russia, and Switzerland criticized this in an internal memorandum, pointing out that Greek debt would be unsustainable. However their French, German and Dutch colleagues refused to reduce the Greek debt or to make (their) private banks pay.

In mid May 2012, the crisis and impossibility to form a new government after elections and the possible victory by the anti-austerity axis led to new speculations Greece would have to leave the eurozone shortly. This phenomenon became known as "Grexit" and started to govern international market behaviour. The centre-right's narrow victory in 17 June election gave hope that Greece would honour its obligations and stay in the Euro-zone.

Due to a delayed reform schedule and a worsened economic recession, the new government immediately asked the Troika to be granted an extended deadline from 2015 to 2017 before being required to restore the budget into a self-financed situation; which in effect was equal to a request of a third bailout package for 2015–16 worth €32.6bn of extra loans. On 11 November 2012, facing a default by the end of November, the Greek parliament passed a new austerity package worth €18.8bn, including a "labour market reform" and "mid term fiscal plan 2013–16". In return, the Eurogroup agreed on the following day to lower interest rates and prolong debt maturities and to provide Greece with additional funds of around €10bn for a debt-buy-back programme. The latter allowed Greece to retire about half of the €62 billion in debt that Athens owes private creditors, thereby shaving roughly €20 billion off that debt. This should bring Greece's debt-to-GDP ratio down to 124% by 2020 and well below 110% two years later. Without agreement the debt-to-GDP ratio would have risen to 188% in 2013.

The Financial Times special report on the future of the European Union argues that the liberalisation of labour markets has allowed Greece to narrow the cost-competitiveness gap with other southern eurozone countries by approximately 50% over the past two years. This has been achieved primary through wage reductions, though businesses have reacted positively. The opening of product and service markets is proving tough because interest groups are slowing reforms. The biggest challenge for Greece is to overhaul the tax administration with a significant part of annually assessed taxes not paid. Poul Thomsen, the IMF official who heads the bailout mission in Greece, stated that "in structural terms, Greece is more than halfway there".

In June 2013, Equity index provider MSCI reclassified Greece as an emerging market, citing failure to qualify on several criteria for market accessibility.

Both of the latest bailout programme audit reports, released independently by the European Commission and IMF in June 2014, revealed that even after transfer of the scheduled bailout funds and full implementation of the agreed adjustment package in 2012, there was a new forecast financing gap of: €5.6bn in 2014, €12.3bn in 2015, and €0bn in 2016. The new forecast financing gaps will need either to be covered by the government's additional lending from private capital markets, or to be countered by additional fiscal improvements through expenditure reductions, revenue hikes or increased amount of privatizations. Due to an improved outlook for the Greek economy, with return of a government structural surplus in 2012, return of real GDP growth in 2014, and a decline of the unemployment rate in 2015, it was possible for the Greek government to return to the bond market during the course of 2014, for the purpose of fully funding its new extra financing gaps with additional private capital. A total of €6.1bn was received from the sale of three-year and five-year bonds in 2014, and the Greek government now plans to cover its forecast financing gap for 2015 with additional sales of seven-year and ten-year bonds in 2015.

The latest recalculation of the seasonally adjusted quarterly GDP figures for the Greek economy revealed that it had been hit by three distinct recessions in the turmoil of the Global Financial Crisis:

- Q3-2007 until Q4-2007 (duration = 2 quarters)

- Q2-2008 until Q1-2009 (duration = 4 quarters, referred to as being part of the Great Recession)

- Q3-2009 until Q4-2013 (duration = 18 quarters, referred to as being part of the eurozone crisis)

Greece experienced positive economic growth in each of the three first quarters of 2014. The return of economic growth, along with the now existing underlying structural budget surplus of the general government, build the basis for the debt-to-GDP ratio to start a significant decline in the coming years ahead, which will help ensure that Greece will be labelled "debt sustainable" and fully regain complete access to private lending markets in 2015. While the Greek government-debt crisis hereby is forecast officially to end in 2015, many of its negative repercussions (e.g. a high unemployment rate) are forecast still to be felt during many of the subsequent years.

During the second half of 2014, the Greek government again negotiated with the Troika. The negotiations were this time about how to comply with the programme requirements, to ensure activation of the payment of its last scheduled eurozone bailout tranche in December 2014, and about a potential update of its remaining bailout programme for 2015–16. When calculating the impact of the 2015 fiscal budget presented by the Greek government, there was a disagreement, with the calculations of the Greek government showing it fully complied with the goals of its agreed "Midterm fiscal plan 2013–16", while the Troika calculations were less optimistic and returned a not covered financing gap at €2.5bn (being required to be covered by additional austerity measures). As the Greek government insisted their calculations were more accurate than those presented by the Troika, they submitted an unchanged fiscal budget bill on 21 November, to be voted for by the parliament on 7 December. The Eurogroup was scheduled to meet and discuss the updated review of the Greek bailout programme on 8 December (to be published on the same day), and the potential adjustments to the remaining programme for 2015–16. There were rumours in the press that the Greek government has proposed immediately to end the previously agreed and continuing IMF bailout programme for 2015–16, replacing it with the transfer of €11bn unused bank recapitalization funds currently held as reserve by the Hellenic Financial Stability Fund (HFSF), along with establishment of a new precautionary Enhanced Conditions Credit Line (ECCL) issued by the European Stability Mechanism. The ECCL instrument is often used as a follow-up precautionary measure, when a state has exited its sovereign bailout programme, with transfers only taking place if adverse financial/economic circumstances materialize, but with the positive effect that it help calm down financial markets as the presence of this extra backup guarantee mechanism makes the environment safer for investors.

The positive economic outlook for Greece—based on the return of seasonally adjusted real GDP growth across the first three quarters of 2014—was replaced by a new fourth recession starting in Q4-2014. This new fourth recession was widely assessed as being direct related to the premature snap parliamentary election called by the Greek parliament in December 2014 and the following formation of a Syriza-led government refusing to accept respecting the terms of its current bailout agreement. The rising political uncertainty of what would follow caused the Troika to suspend all scheduled remaining aid to Greece under its second programme, until such time as the Greek government either accepted the previously negotiated conditional payment terms or alternatively could reach a mutually accepted agreement of some new updated terms with its public creditors. This rift caused a renewed increasingly growing liquidity crisis (both for the Greek government and Greek financial system), resulting in plummeting stock prices at the Athens Stock Exchange while interest rates for the Greek government at the private lending market spiked to levels once again making it inaccessible as an alternative funding source.

Faced by the threat of a sovereign default and potential resulting exit of the eurozone, some final attempts were made by the Greek government in May 2015 to settle an agreement with the Troika about some adjusted terms for Greece to comply with in order to activate the transfer of the frozen bailout funds in its second programme. In the process, the Eurogroup granted a six-month technical extension of its second bailout programme to Greece.

On 5 July 2015, the citizens of Greece voted decisively (a 61% to 39% decision with 62.5% voter turnout) to reject a referendum that would have given Greece more bailout help from other EU members in return for increased austerity measures. As a result of this vote, Greece's finance minister Yanis Varoufakis stepped down on 6 July. Greece was the first developed country not to make a payment to the IMF on time, in 2015 (payment was made with a 20-day delay). Eventually, Greece agreed on a third bailout package in August 2015.

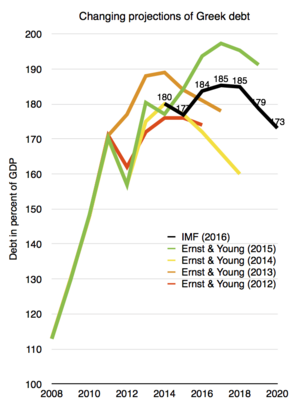

Between 2009 and 2017 the Greek government debt rose from €300 bn to €318 bn, i.e. by only about 6% (thanks, in part, to the 2012 debt restructuring); however, during the same period, the critical debt-to-GDP ratio shot up from 127% to 179% basically due to the severe GDP drop during the handling of the crisis.

Greece's bailouts successfully ended (as declared) on 20 August 2018.

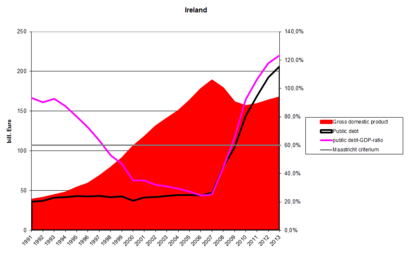

Ireland

The Irish sovereign debt crisis arose not from government over-spending, but from the state guaranteeing the six main Irish-based banks who had financed a property bubble. On 29 September 2008, Finance Minister Brian Lenihan Jnr issued a two-year guarantee to the banks' depositors and bondholders. The guarantees were subsequently renewed for new deposits and bonds in a slightly different manner. In 2009, a National Asset Management Agency (NAMA) was created to acquire large property-related loans from the six banks at a market-related "long-term economic value".

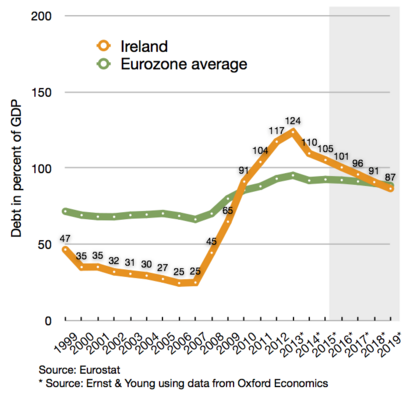

Irish banks had lost an estimated 100 billion euros, much of it related to defaulted loans to property developers and homeowners made in the midst of the property bubble, which burst around 2007. The economy collapsed during 2008. Unemployment rose from 4% in 2006 to 14% by 2010, while the national budget went from a surplus in 2007 to a deficit of 32% GDP in 2010, the highest in the history of the eurozone, despite austerity measures.

With Ireland's credit rating falling rapidly in the face of mounting estimates of the banking losses, guaranteed depositors and bondholders cashed in during 2009–10, and especially after August 2010. (The necessary funds were borrowed from the central bank.) With yields on Irish Government debt rising rapidly, it was clear that the Government would have to seek assistance from the EU and IMF, resulting in a €67.5 billion "bailout" agreement of 29 November 2010. Together with additional €17.5 billion coming from Ireland's own reserves and pensions, the government received €85 billion, of which up to €34 billion was to be used to support the country's failing financial sector (only about half of this was used in that way following stress tests conducted in 2011). In return the government agreed to reduce its budget deficit to below three per cent by 2015. In April 2011, despite all the measures taken, Moody's downgraded the banks' debt to junk status.

In July 2011, European leaders agreed to cut the interest rate that Ireland was paying on its EU/IMF bailout loan from around 6% to between 3.5% and 4% and to double the loan time to 15 years. The move was expected to save the country between 600 and 700 million euros per year. On 14 September 2011, in a move to further ease Ireland's difficult financial situation, the European Commission announced it would cut the interest rate on its €22.5 billion loan coming from the European Financial Stability Mechanism, down to 2.59 per cent—which is the interest rate the EU itself pays to borrow from financial markets.

The Euro Plus Monitor report from November 2011 attests to Ireland's vast progress in dealing with its financial crisis, expecting the country to stand on its own feet again and finance itself without any external support from the second half of 2012 onwards. According to the Centre for Economics and Business Research, Ireland's export-led recovery "will gradually pull its economy out of its trough". As a result of the improved economic outlook, the cost of 10-year government bonds has fallen from its record high at 12% in mid July 2011 to below 4% in 2013 (see the graph "Long-term Interest Rates").

On 26 July 2012, for the first time since September 2010, Ireland was able to return to the financial markets, selling over €5 billion in long-term government debt, with an interest rate of 5.9% for the 5-year bonds and 6.1% for the 8-year bonds at sale. In December 2013, after three years on financial life support, Ireland finally left the EU/IMF bailout programme, although it retained a debt of €22.5 billion to the IMF; in August 2014, early repayment of €15 billion was being considered, which would save the country €375 million in surcharges. Despite the end of the bailout the country's unemployment rate remains high and public sector wages are still around 20% lower than at the beginning of the crisis. Government debt reached 123.7% of GDP in 2013.

On 13 March 2013, Ireland managed to regain complete lending access on financial markets, when it successfully issued €5bn of 10-year maturity bonds at a yield of 4.3%. Ireland ended its bailout programme as scheduled in December 2013, without any need for additional financial support.

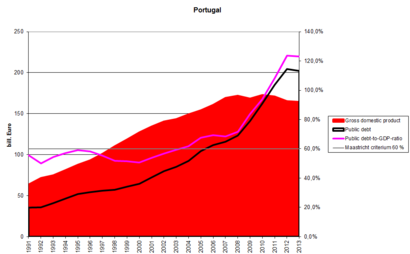

Portugal

Unlike other European countries that were also severely hit by the Great Recession in the late 2000s and eventually received bailouts in the early 2010s (such as Greece and Ireland), Portugal had the characteristic that the 2000s were not marked by economic growth, but were already a period of economic crisis, marked by stagnation, two recessions (in 2002–03 and 2008–09) and government-sponsored fiscal austerity in order to reduce the budget deficit to the limits allowed by the European Union's Stability and Growth Pact.

According to a report by the Diário de Notícias, Portugal had allowed considerable slippage in state-managed public works and inflated top management and head officer bonuses and wages in the period between the Carnation Revolution in 1974 and 2010. Persistent and lasting recruitment policies boosted the number of redundant public servants. Risky credit, public debt creation, and European structural and cohesion funds were mismanaged across almost four decades. When the global crisis disrupted the markets and the world economy, together with the US subprime mortgage crisis and the eurozone crisis, Portugal was one of the first economies to succumb, and was affected very deeply.

In the summer of 2010, Moody's Investors Service cut Portugal's sovereign bond rating, which led to an increased pressure on Portuguese government bonds. In the first half of 2011, Portugal requested a €78 billion IMF-EU bailout package in a bid to stabilise its public finances.

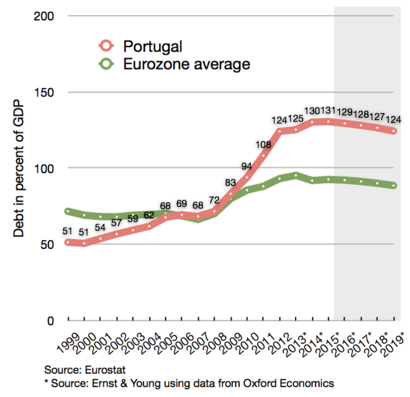

Portugal's debt was in September 2012 forecast by the Troika to peak at around 124% of GDP in 2014, followed by a firm downward trajectory after 2014. Previously the Troika had predicted it would peak at 118.5% of GDP in 2013, so the developments proved to be a bit worse than first anticipated, but the situation was described as fully sustainable and progressing well. As a result, from the slightly worse economic circumstances, the country has been given one more year to reduce the budget deficit to a level below 3% of GDP, moving the target year from 2013 to 2014. The budget deficit for 2012 has been forecast to end at 5%. The recession in the economy is now also projected to last until 2013, with GDP declining 3% in 2012 and 1% in 2013; followed by a return to positive real growth in 2014. Unemployment rate increased to over 17% by end of 2012 but it has since decreased gradually to 10,5% as of November 2016.

As part of the bailout programme, Portugal was required to regain complete access to financial markets by September 2013. The first step towards this target was successfully taken on 3 October 2012, when the country managed to regain partial market access by selling a bond series with 3-year maturity. Once Portugal regains complete market access, measured as the moment it successfully manages to sell a bond series with a full 10-year maturity, it is expected to benefit from interventions by the ECB, which announced readiness to implement extended support in the form of some yield-lowering bond purchases (OMTs), aiming to bring governmental interest rates down to sustainable levels. A peak for the Portuguese 10-year governmental interest rates happened on 30 January 2012, where it reached 17.3% after the rating agencies had cut the governments credit rating to "non-investment grade" (also referred to as "junk"). As of December 2012, it has been more than halved to only 7%. A successful return to the long-term lending market was made by the issuing of a 5-year maturity bond series in January 2013, and the state regained complete lending access when it successfully issued a 10-year maturity bond series on 7 May 2013.

According to the Financial Times special report on the future of the European Union, the Portuguese government has "made progress in reforming labour legislation, cutting previously generous redundancy payments by more than half and freeing smaller employers from collective bargaining obligations, all components of Portugal's €78 billion bailout program". Additionally, unit labour costs have fallen since 2009, working practices are liberalizing, and industrial licensing is being streamlined.

On 18 May 2014, Portugal left the EU bailout mechanism without additional need for support, as it had already regained a complete access to lending markets back in May 2013, and with its latest issuing of a 10-year government bond being successfully completed with a rate as low as 3.59%. Portugal still has many tough years ahead. During the crisis, Portugal's government debt increased from 93 to 139 percent of GDP. On 3 August 2014, Banco de Portugal announced the country's second biggest bank Banco Espírito Santo would be split in two after losing the equivalent of $4.8 billion in the first 6 months of 2014, sending its shares down by 89 percent.

Spain

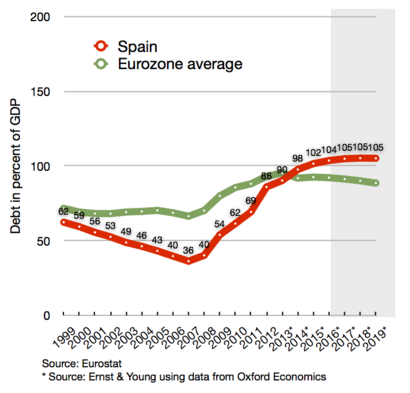

Spain had a comparatively low debt level among advanced economies prior to the crisis. Its public debt relative to GDP in 2010 was only 60%, more than 20 points less than Germany, France or the US, and more than 60 points less than Italy or Greece. Debt was largely avoided by the ballooning tax revenue from the housing bubble, which helped accommodate a decade of increased government spending without debt accumulation. When the bubble burst, Spain spent large amounts of money on bank bailouts. In May 2012, Bankia received a 19 billion euro bailout, on top of the previous 4.5 billion euros to prop up Bankia. Questionable accounting methods disguised bank losses. During September 2012, regulators indicated that Spanish banks required €59 billion (US$77 billion) in additional capital to offset losses from real estate investments.

The bank bailouts and the economic downturn increased the country's deficit and debt levels and led to a substantial downgrading of its credit rating. To build up trust in the financial markets, the government began to introduce austerity measures and in 2011 it passed a law in congress to approve an amendment to the Spanish Constitution to require a balanced budget at both the national and regional level by 2020. The amendment states that public debt can not exceed 60% of GDP, though exceptions would be made in case of a natural catastrophe, economic recession or other emergencies. As one of the largest eurozone economies (larger than Greece, Portugal and Ireland combined) the condition of Spain's economy is of particular concern to international observers. Under pressure from the United States, the IMF, other European countries and the European Commission the Spanish governments eventually succeeded in trimming the deficit from 11.2% of GDP in 2009 to 7.1% in 2013.

Nevertheless, in June 2012, Spain became a prime concern for the Euro-zone when interest on Spain's 10-year bonds reached the 7% level and it faced difficulty in accessing bond markets. This led the Eurogroup on 9 June 2012 to grant Spain a financial support package of up to €100 billion. The funds will not go directly to Spanish banks, but be transferred to a government-owned Spanish fund responsible to conduct the needed bank recapitalisations (FROB), and thus it will be counted for as additional sovereign debt in Spain's national account. An economic forecast in June 2012 highlighted the need for the arranged bank recapitalisation support package, as the outlook promised a negative growth rate of 1.7%, unemployment rising to 25%, and a continued declining trend for housing prices. In September 2012 the ECB removed some of the pressure from Spain on financial markets, when it announced its "unlimited bond-buying plan", to be initiated if Spain would sign a new sovereign bailout package with EFSF/ESM. Strictly speaking, Spain was not hit by a sovereign debt-crisis in 2012, as the financial support package that they received from the ESM was earmarked for a bank recapitalization fund and did not include financial support for the government itself.

According to the latest debt sustainability analysis published by the European Commission in October 2012, the fiscal outlook for Spain, if assuming the country will stick to the fiscal consolidation path and targets outlined by the country's current EDP programme, will result in a debt-to-GDP ratio reaching its maximum at 110% in 2018—followed by a declining trend in subsequent years. In regards of the structural deficit the same outlook has promised, that it will gradually decline to comply with the maximum 0.5% level required by the Fiscal Compact in 2022/2027.

Though Spain was suffering with 27% unemployment and the economy was shrinking 1.4% in 2013, Mariano Rajoy's conservative government has pledged to speed up reforms, according to the Financial Times special report on the future of the European Union. "Madrid is reviewing its labour market and pension reforms and has promised by the end of this year to liberalize its heavily regulated professions". But Spain is benefiting from improved labour cost competitiveness. "They have not lost export market share," says Eric Chaney, chief economist at Axa. "If credit starts flowing again, Spain could surprise us".

On 23 January 2014, as foreign investor confidence in the country has been restored, Spain formally exited the EU/IMF bailout mechanism. By the end of March 2018, unemployment rate of Spain has fallen to 16.1% and the debt is 98,30% of the GDP.

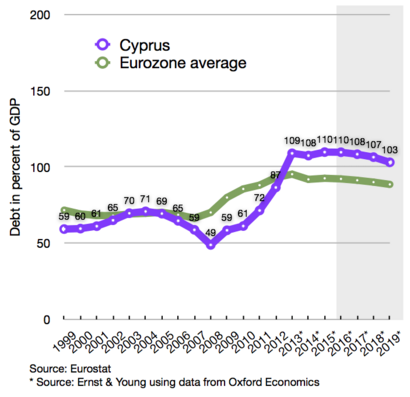

Cyprus

The economy of the small island of Cyprus with 840,000 people was hit by several huge blows in and around 2012 including, amongst other things, the €22 billion exposure of Cypriot banks to the Greek debt haircut, the downgrading of the Cypriot economy into junk status by international rating agencies and the inability of the government to refund its state expenses.

On 25 June 2012, the Cypriot Government requested a bailout from the European Financial Stability Facility or the European Stability Mechanism, citing difficulties in supporting its banking sector from the exposure to the Greek debt haircut.

On 30 November the Troika (the European Commission, the International Monetary Fund, and the European Central Bank) and the Cypriot Government had agreed on the bailout terms with only the amount of money required for the bailout remaining to be agreed upon. Bailout terms include strong austerity measures, including cuts in civil service salaries, social benefits, allowances and pensions and increases in VAT, tobacco, alcohol and fuel taxes, taxes on lottery winnings, property, and higher public health care charges. At the insistence of the Commission negotiators, at first the proposal also included an unprecedented one-off levy of 6.7% for deposits up to €100,000 and 9.9% for higher deposits on all domestic bank accounts. Following public outcry, the eurozone finance ministers were forced to change the levy, excluding deposits of less than €100,000, and introducing a higher 15.6% levy on deposits of above €100,000 ($129,600)—in line with the EU minimum deposit guarantee. This revised deal was also rejected by the Cypriot parliament on 19 March 2013 with 36 votes against, 19 abstentions and one not present for the vote.

The final agreement was settled on 25 March 2013, with the proposal to close the most troubled Laiki Bank, which helped significantly to reduce the needed loan amount for the overall bailout package, so that €10bn was sufficient without need for imposing a general levy on bank deposits. The final conditions for activation of the bailout package was outlined by the Troika's MoU agreement, which was endorsed in full by the Cypriot House of Representatives on 30 April 2013. It includes:

- Recapitalisation of the entire financial sector while accepting a closure of the Laiki bank,

- Implementation of the anti-money laundering framework in Cypriot financial institutions,

- Fiscal consolidation to help bring down the Cypriot governmental budget deficit,

- Structural reforms to restore competitiveness and macroeconomic imbalances,

- Privatization programme.

The Cypriot debt-to-GDP ratio is on this background now forecasted only to peak at 126% in 2015 and subsequently decline to 105% in 2020, and thus considered to remain within sustainable territory.

Although the bailout support programme feature sufficient financial transfers until March 2016, Cyprus began slowly to regain its access to the private lending markets already in June 2014. At this point of time, the government sold €0.75bn of bonds with a five-year maturity, to the tune of a 4.85% yield. A continued selling of bonds with a ten-year maturity, which would equal a regain of complete access to the private lending market (and mark the end of the era with need for bailout support), is expected to happen sometime in 2015. The Cypriot minister of finance recently confirmed, that the government plan to issue two new European Medium Term Note (EMTN) bonds in 2015, likely shortly ahead of the expiry of another €1.1bn bond on 1 July and a second expiry of a €0.9bn bond on 1 November. As announced in advance, the Cypriot government issued €1bn of seven-year bonds with a 4.0% yield by the end of April 2015.

Policy reactions

EU emergency measures

The table below provides an overview of the financial composition of all bailout programs being initiated for EU member states, since the global financial crisis erupted in September 2008. EU member states outside the eurozone (marked with yellow in the table) have no access to the funds provided by EFSF/ESM, but can be covered with rescue loans from EU's Balance of Payments programme (BoP), IMF and bilateral loans (with an extra possible assistance from the Worldbank/EIB/EBRD if classified as a development country). Since October 2012, the ESM as a permanent new financial stability fund to cover any future potential bailout packages within the eurozone, has effectively replaced the now defunct GLF + EFSM + EFSF funds. Whenever pledged funds in a scheduled bailout program were not transferred in full, the table has noted this by writing "Y out of X".

| EU member | Time span | IMF (billion €) |

World Bank (billion €) |

EIB / EBRD (billion €) |

Bilateral (billion €) |

BoP (billion €) |

GLF (billion €) |

EFSM (billion €) |

EFSF (billion €) |

ESM (billion €) |

Bailout in total (billion €) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Cyprus I1 | Dec.2011-Dec.2012 | – | – | – | 2.5 | – | – | – | – | – | 2.51 |

| Cyprus II2 | May 2013-Mar.2016 | 1.0 | – | – | – | – | – | – | – | 9.0 | 10.02 |

| Greece I+II3 | May 2010-Jun.2015 | 32.1 out of 48.1 | – | – | – | – | 52.9 | – | 130.9 out of 144.6 | – | 215.9 out of 245.63 |

| Greece III4 | Aug.2015-Aug.2018 | (proportion of 86, to be decided Oct.2015) |

– | – | – | – | – | – | – | (up till 86) | 864 |

| Hungary5 | Nov.2008-Oct.2010 | 9.1 out of 12.5 | 1.0 | – | – | 5.5 out of 6.5 | – | – | – | – | 15.6 out of 20.05 |

| Ireland6 | Nov.2010-Dec.2013 | 22.5 | – | – | 4.8 | – | – | 22.5 | 18.4 | – | 68.26 |

| Latvia7 | Dec.2008-Dec.2011 | 1.1 out of 1.7 | 0.4 | 0.1 | 0.0 out of 2.2 | 2.9 out of 3.1 | – | – | – | – | 4.5 out of 7.57 |

| Portugal8 | May 2011-Jun 2014 | 26.5 out of 27.4 | – | – | – | – | – | 24.3 out of 25.6 | 26.0 | – | 76.8 out of 79.08 |

| Romania I9 | May 2009-Jun 2011 | 12.6 out of 13.6 | 1.0 | 1.0 | – | 5.0 | – | – | – | – | 19.6 out of 20.69 |

| Romania II10 | Mar 2011-Jun 2013 | 0.0 out of 3.6 | 1.15 | – | – | 0.0 out of 1.4 | – | – | – | – | 1.15 out of 6.1510 |

| Romania III11 | Oct 2013-Sep 2015 | 0.0 out of 2.0 | 2.5 | – | – | 0.0 out of 2.0 | – | – | – | – | 2.5 out of 6.511 |

| Spain12 | July 2012-Dec.2013 | – | – | – | – | – | – | – | – | 41.3 out of 100 | 41.3 out of 10012 |

| Total payment | Nov.2008-Aug.2018 | 104.9 | 6.05 | 1.1 | 7.3 | 13.4 | 52.9 | 46.8 | 175.3 | 136.3 | 544.05 |

| 1 Cyprus received in late December 2011 a €2.5bn bilateral emergency bailout loan from Russia, to cover its governmental budget deficits and a refinancing of maturing governmental debts until 31 December 2012. Initially the bailout loan was supposed to be fully repaid in 2016, but as part of establishment of the later following second Cypriot bailout programme, Russia accepted a delayed repayment in eight biannual tranches throughout 2018–2021 - while also lowering its requested interest rate from 4.5% to 2.5%. |

| 2 When it became evident Cyprus needed an additional bailout loan to cover the government's fiscal operations throughout 2013–2015, on top of additional funding needs for recapitalization of the Cypriot financial sector, negotiations for such an extra bailout package started with the Troika in June 2012. In December 2012 a preliminary estimate indicated, that the needed overall bailout package should have a size of €17.5bn, comprising €10bn for bank recapitalisation and €6.0bn for refinancing maturing debt plus €1.5bn to cover budget deficits in 2013+2014+2015, which in total would have increased the Cypriot debt-to-GDP ratio to around 140%. The final agreed package however only entailed a €10bn support package, financed partly by IMF (€1bn) and ESM (€9bn), because it was possible to reach a fund saving agreement with the Cypriot authorities, featuring a direct closure of the most troubled Laiki Bank and a forced bail-in recapitalisation plan for Bank of Cyprus. The final conditions for activation of the bailout package was outlined by the Troika's MoU agreement in April 2013, and include: (1) Recapitalisation of the entire financial sector while accepting a closure of the Laiki bank, (2) Implementation of the anti-money laundering framework in Cypriot financial institutions, (3) Fiscal consolidation to help bring down the Cypriot governmental budget deficit, (4) Structural reforms to restore competitiveness and macroeconomic imbalances, (5) Privatization programme. The Cypriot debt-to-GDP ratio is on this background now forecasted only to peak at 126% in 2015 and subsequently decline to 105% in 2020, and thus considered to remain within sustainable territory. The €10bn bailout comprise €4.1bn spend on debt liabilities (refinancing and amortization), 3.4bn to cover fiscal deficits, and €2.5bn for the bank recapitalization. These amounts will be paid to Cyprus through regular tranches from 13 May 2013 until 31 March 2016. According to the programme this will be sufficient, as Cyprus during the programme period in addition will: Receive €1.0bn extraordinary revenue from privatization of government assets, ensure an automatic roll-over of €1.0bn maturing Treasury Bills and €1.0bn of maturing bonds held by domestic creditors, bring down the funding need for bank recapitalization with €8.7bn — of which 0.4bn is reinjection of future profit earned by the Cyprus Central Bank (injected in advance at the short term by selling its gold reserve) and €8.3bn origin from the bail-in of creditors in Laiki bank and Bank of Cyprus. The forced automatic rollover of maturing bonds held by domestic creditors were conducted in 2013, and equaled according to some credit rating agencies a "selective default" or "restrictive default", mainly because the fixed yields of the new bonds did not reflect the market rates — while maturities at the same time automatically were extended. |

| 3 Many sources list the first bailout was €110bn followed by the second on €130bn. When you deduct €2.7bn due to Ireland+Portugal+Slovakia opting out as creditors for the first bailout, and add the extra €8.2bn IMF has promised to pay Greece for the years in 2015-16 (through a programme extension implemented in December 2012), the total amount of bailout funds sums up to €245.6bn. The first bailout resulted in a payout of €20.1bn from IMF and €52.9bn from GLF, during the course of May 2010 until December 2011, and then it was technically replaced by a second bailout package for 2012-2016, which had a size of €172.6bn (€28bn from IMF and €144.6bn from EFSF), as it included the remaining committed amounts from the first bailout package. All committed IMF amounts were made available to the Greek government for financing its continued operation of public budget deficits and to refinance maturing public debt held by private creditors and IMF. The payments from EFSF were earmarked to finance €35.6bn of PSI restructured government debt (as part of a deal where private investors in return accepted a nominal haircut, lower interest rates and longer maturities for their remaining principal), €48.2bn for bank recapitalization, €11.3bn for a second PSI debt buy-back, while the remaining €49.5bn were made available to cover continued operation of public budget deficits. The combined programme was scheduled to expire in March 2016, after IMF had extended their programme period with extra loan tranches from January 2015 to March 2016 (as a mean to help Greece service the total sum of interests accruing during the lifespan of already issued IMF loans), while the Eurogroup at the same time opted to conduct their reimbursement and deferral of interests outside their bailout programme framework — with the EFSF programme still being planned to end in December 2014. Due to the refusal by the Greek government to comply with the agreed conditional terms for receiving a continued flow of bailout transfers, both IMF and the Eurogroup opted to freeze their programmes since August 2014. To avoid a technical expiry, the Eurogroup postponed the expiry date for its frozen programme to 30 June 2015, paving the way within this new deadline for the possibility of transfer terms first to be renegotiated and then finally complied with to ensure completion of the programme. As Greece withdrew unilaterally from the process of settling renegotiated terms and time extension for the completion of the programme, it expired uncompleted on 30 June 2015. Hereby, Greece lost the possibility to extract €13.7bn of remaining funds from the EFSF (€1.0bn unused PSI and Bond Interest facilities, €10.9bn unused bank recapitalization funds and a €1.8bn frozen tranche of macroeconomic support), and also lost the remaining SDR 13.561bn of IMF funds (being equal to €16.0bn as per the SDR exchange rate on 5 Jan 2012 ), although those lost IMF funds might be recouped if Greece settles an agreement for a new third bailout programme with ESM — and passes the first review of such programme. |

| 4 A new third bailout programme worth €86bn in total, jointly covered by funds from IMF and ESM, will be disbursed in tranches from August 2015 until August 2018. The programme was approved to be negotiated on 17 July 2015, and approved in full detail by the publication of an ESM facility agreement on 19 August 2015. IMF's transfer of the "remainder of its frozen I+II programme" and their new commitment also to contribute with a part of the funds for the third bailout, depends on a successful prior completion of the first review of the new third programme in October 2015. Due to a matter of urgency, EFSM immediately conducted a temporary €7.16bn emergency transfer to Greece on 20 July 2015, which was fully overtaken by ESM when the first tranche of the third program was conducted 20 August 2015. Due to being temporary bridge financing and not part of an official bailout programme, the table do not display this special type of EFSM transfer. The loans of the program has an average maturity of 32.5 years and carry a variable interest rate (currently at 1%). The program has earmarked transfer of up till €25bn for bank recapitalization purposes (to be used to the extent deemed needed by the annual stress tests of European Banking Supervision), and also include establishment of a new privatization fund to conduct sale of Greek public assets — of which the first generated €25bn will be used for early repayment of the bailout loans earmarked for bank recapitalizations. Potential debt relief for Greece, in the form of longer grace and payment periods, will be considered by the European public creditors after the first review of the new programme, by October/November 2015. |

| 5 Hungary recovered faster than expected, and thus did not receive the remaining €4.4bn bailout support scheduled for October 2009-October 2010. IMF paid in total 7.6 out of 10.5 billion SDR, equal to €9.1bn out of €12.5bn at current exchange rates. |

| 6 In Ireland the National Treasury Management Agency also paid €17.5bn for the program on behalf of the Irish government, of which €10bn were injected by the National Pensions Reserve Fund and the remaining €7.5bn paid by "domestic cash resources", which helped increase the program total to €85bn. As this extra amount by technical terms is an internal bail-in, it has not been added to the bailout total. As of 31 March 2014 all committed funds had been transferred, with EFSF even paying €0.7bn more, so that the total amount of funds had been marginally increased from €67.5bn to €68.2bn. |

| 7 Latvia recovered faster than expected, and thus did not receive the remaining €3.0bn bailout support originally scheduled for 2011. |

| 8 Portugal completed its support programme as scheduled in June 2014, one month later than initially planned due to awaiting a verdict by its constitutional court, but without asking for establishment of any subsequent precautionary credit line facility. By the end of the programme all committed amounts had been transferred, except for the last tranche of €2.6bn (1.7bn from EFSM and 0.9bn from IMF), which the Portuguese government declined to receive. The reason why the IMF transfers still mounted to slightly more than the initially committed €26bn, was due to its payment with SDR's instead of euro — and some favorable developments in the EUR-SDR exchange rate compared to the beginning of the programme. In November 2014, Portugal received its last delayed €0.4bn tranche from EFSM (post programme), hereby bringing its total drawn bailout amount up at €76.8bn out of €79.0bn. |

| 9 Romania recovered faster than expected, and thus did not receive the remaining €1.0bn bailout support originally scheduled for 2011. |

| 10 Romania had a precautionary credit line with €5.0bn available to draw money from if needed, during the period March 2011-June 2013; but entirely avoided to draw on it. During the period, the World Bank however supported with a transfer of €0.4bn as a DPL3 development loan programme and €0.75bn as results based financing for social assistance and health. |

| 11 Romania had a second €4bn precautionary credit line established jointly by IMF and EU, of which IMF accounts for SDR 1.75134bn = €2bn, which is available to draw money from if needed during the period from October 2013 to 30 September 2015. In addition the World Bank also made €1bn available under a Development Policy Loan with a deferred drawdown option valid from January 2013 through December 2015. The World Bank will throughout the period also continue providing earlier committed development programme support of €0.891bn, but this extra transfer is not accounted for as "bailout support" in the third programme due to being "earlier committed amounts". In April 2014, the World Bank increased their support by adding the transfer of a first €0.75bn Fiscal Effectiveness and Growth Development Policy Loan, with the final second FEG-DPL tranch on €0.75bn (worth about $1bn) to be contracted in the first part of 2015. No money had been drawn from the precautionary credit line, as of May 2014. |

| 12 Spain's €100bn support package has been earmarked only for recapitalisation of the financial sector. Initially an EFSF emergency account with €30bn was available, but nothing was drawn, and it was cancelled again in November 2012 after being superseded by the regular ESM recapitalisation programme. The first ESM recapitalisation tranch of €39.47bn was approved 28 November, and transferred to the bank recapitalisation fund of the Spanish government (FROB) on 11 December 2012. A second tranch for "category 2" banks on €1.86n was approved by the Commission on 20 December, and finally transferred by ESM on 5 February 2013. "Category 3" banks were also subject for a possible third tranch in June 2013, in case they failed before then to acquire sufficient additional capital funding from private markets. During January 2013, all "category 3" banks however managed to fully recapitalise through private markets and thus will not be in need for any State aid. The remaining €58.7bn of the initial support package is thus not expected to be activated, but will stay available as a fund with precautionary capital reserves to possibly draw upon if unexpected things happen — until 31 December 2013. In total €41.3bn out of the available €100bn was transferred. Upon the scheduled exit of the programme, no follow-up assistance was requested. |

European Financial Stability Facility (EFSF)

On 9 May 2010, the 27 EU member states agreed to create the European Financial Stability Facility, a legal instrument aiming at preserving financial stability in Europe, by providing financial assistance to eurozone states in difficulty. The EFSF can issue bonds or other debt instruments on the market with the support of the German Debt Management Office to raise the funds needed to provide loans to eurozone countries in financial troubles, recapitalise banks or buy sovereign debt.

Emissions of bonds are backed by guarantees given by the euro area member states in proportion to their share in the paid-up capital of the European Central Bank. The €440 billion lending capacity of the facility is jointly and severally guaranteed by the eurozone countries' governments and may be combined with loans up to €60 billion from the European Financial Stabilisation Mechanism (reliant on funds raised by the European Commission using the EU budget as collateral) and up to €250 billion from the International Monetary Fund (IMF) to obtain a financial safety net up to €750 billion.

The EFSF issued €5 billion of five-year bonds in its inaugural benchmark issue 25 January 2011, attracting an order book of €44.5 billion. This amount is a record for any sovereign bond in Europe, and €24.5 billion more than the European Financial Stabilisation Mechanism (EFSM), a separate European Union funding vehicle, with a €5 billion issue in the first week of January 2011.

On 29 November 2011, the member state finance ministers agreed to expand the EFSF by creating certificates that could guarantee up to 30% of new issues from troubled euro-area governments, and to create investment vehicles that would boost the EFSF's firepower to intervene in primary and secondary bond markets.

The transfers of bailout funds were performed in tranches over several years and were conditional on the governments simultaneously implementing a package of fiscal consolidation, structural reforms, privatization of public assets and setting up funds for further bank recapitalization and resolution.

European Financial Stabilisation Mechanism (EFSM)

On 5 January 2011, the European Union created the European Financial Stabilisation Mechanism (EFSM), an emergency funding programme reliant upon funds raised on the financial markets and guaranteed by the European Commission using the budget of the European Union as collateral. It runs under the supervision of the Commission and aims at preserving financial stability in Europe by providing financial assistance to EU member states in economic difficulty. The Commission fund, backed by all 27 European Union members, has the authority to raise up to €60 billion and is rated AAA by Fitch, Moody's and Standard & Poor's.

Under the EFSM, the EU successfully placed in the capital markets an €5 billion issue of bonds as part of the financial support package agreed for Ireland, at a borrowing cost for the EFSM of 2.59%.

Like the EFSF, the EFSM was replaced by the permanent rescue funding programme ESM, which was launched in September 2012.

Brussels agreement and aftermath

On 26 October 2011, leaders of the 17 eurozone countries met in Brussels and agreed on a 50% write-off of Greek sovereign debt held by banks, a fourfold increase (to about €1 trillion) in bail-out funds held under the European Financial Stability Facility, an increased mandatory level of 9% for bank capitalisation within the EU and a set of commitments from Italy to take measures to reduce its national debt. Also pledged was €35 billion in "credit enhancement" to mitigate losses likely to be suffered by European banks. European Commission president José Manuel Barroso characterised the package as a set of "exceptional measures for exceptional times".

The package's acceptance was put into doubt on 31 October when Greek Prime Minister George Papandreou announced that a referendum would be held so that the Greek people would have the final say on the bailout, upsetting financial markets. On 3 November 2011 the promised Greek referendum on the bailout package was withdrawn by Prime Minister Papandreou.

In late 2011, Landon Thomas in the New York Times noted that some, at least, European banks were maintaining high dividend payout rates and none were getting capital injections from their governments even while being required to improve capital ratios. Thomas quoted Richard Koo, an economist based in Japan, an expert on that country's banking crisis, and specialist in balance sheet recessions, as saying:

I do not think Europeans understand the implications of a systemic banking crisis. ... When all banks are forced to raise capital at the same time, the result is going to be even weaker banks and an even longer recession—if not depression. ... Government intervention should be the first resort, not the last resort.

Beyond equity issuance and debt-to-equity conversion, then, one analyst "said that as banks find it more difficult to raise funds, they will move faster to cut down on loans and unload lagging assets" as they work to improve capital ratios. This latter contraction of balance sheets "could lead to a depression", the analyst said. Reduced lending was a circumstance already at the time being seen in a "deepen[ing] crisis" in commodities trade finance in western Europe.

- Final agreement on the second bailout package

In a marathon meeting on 20/21 February 2012 the Eurogroup agreed with the IMF and the Institute of International Finance on the final conditions of the second bailout package worth €130 billion. The lenders agreed to increase the nominal haircut from 50% to 53.5%. EU Member States agreed to an additional retroactive lowering of the interest rates of the Greek Loan Facility to a level of just 150 basis points above Euribor. Furthermore, governments of Member States where central banks currently hold Greek government bonds in their investment portfolio commit to pass on to Greece an amount equal to any future income until 2020. Altogether this should bring down Greece's debt to between 117% and 120.5% of GDP by 2020.

European Central Bank

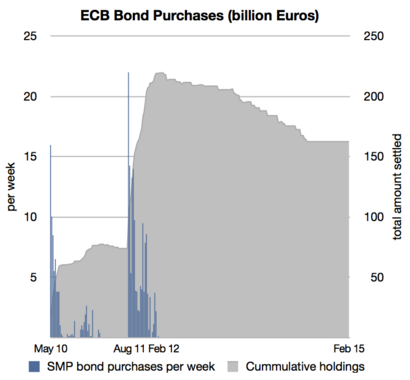

The European Central Bank (ECB) has taken a series of measures aimed at reducing volatility in the financial markets and at improving liquidity.

In May 2010 it took the following actions:

- It began open market operations buying government and private debt securities, reaching €219.5 billion in February 2012, though it simultaneously absorbed the same amount of liquidity to prevent a rise in inflation. According to Rabobank economist Elwin de Groot, there is a "natural limit" of €300 billion the ECB can sterilise.

- It reactivated the dollar swap lines with Federal Reserve support.

- It changed its policy regarding the necessary credit rating for loan deposits, accepting as collateral all outstanding and new debt instruments issued or guaranteed by the Greek government, regardless of the nation's credit rating.

The move took some pressure off Greek government bonds, which had just been downgraded to junk status, making it difficult for the government to raise money on capital markets.

On 30 November 2011, the ECB, the US Federal Reserve, the central banks of Canada, Japan, Britain and the Swiss National Bank provided global financial markets with additional liquidity to ward off the debt crisis and to support the real economy. The central banks agreed to lower the cost of dollar currency swaps by 50 basis points to come into effect on 5 December 2011. They also agreed to provide each other with abundant liquidity to make sure that commercial banks stay liquid in other currencies.

With the aim of boosting the recovery in the eurozone economy by lowering interest rates for businesses, the ECB cut its bank rates in multiple steps in 2012–2013, reaching an historic low of 0.25% in November 2013. The lowered borrowing rates have also caused the euro to fall in relation to other currencies, which is hoped will boost exports from the eurozone and further aid the recovery.

With inflation falling to 0.5% in May 2014, the ECB again took measures to stimulate the eurozone economy, which grew at just 0.2% during the first quarter of 2014. (Deflation or very low inflation encourages holding cash, causing a decrease in purchases). On 5 June, the central bank cut the prime interest rate to 0.15%, and set the deposit rate at −0.10%. The latter move in particular was seen as "a bold and unusual move", as a negative interest rate had never been tried on a wide-scale before. Additionally, the ECB announced it would offer long-term four-year loans at the cheap rate (normally the rate is primarily for overnight lending), but only if the borrowing banks met strict conditions designed to ensure the funds ended up in the hands of businesses instead of, for example, being used to buy low risk government bonds. Collectively, the moves are aimed at avoiding deflation, devaluing the euro to make exportation more viable, and at increasing "real world" lending.

Stock markets reacted strongly to the ECB rate cuts. The German DAX index, for example, set a record high the day the new rates were announced. Meanwhile, the euro briefly fell to a four-month low against the dollar. However, due to the unprecedented nature of the negative interest rate, the long-term effects of the stimulus measures are hard to predict. Bank president Mario Draghi signalled the central bank was willing to do whatever it takes to turn around the eurozone economies, remarking "Are we finished? The answer is no". He laid the groundwork for large-scale bond repurchasing, a controversial idea known as quantitative easing.

- Resignations

In September 2011, Jürgen Stark became the second German after Axel A. Weber to resign from the ECB Governing Council in 2011. Weber, the former Deutsche Bundesbank president, was once thought to be a likely successor to Jean-Claude Trichet as bank president. He and Stark were both thought to have resigned due to "unhappiness with the ECB's bond purchases, which critics say erode the bank's independence". Stark was "probably the most hawkish" member of the council when he resigned. Weber was replaced by his Bundesbank successor Jens Weidmann, while Belgium's Peter Praet took Stark's original position, heading the ECB's economics department.

- Long Term Refinancing Operation (LTRO)

On 22 December 2011, the ECB started the biggest infusion of credit into the European banking system in the euro's 13-year history. Under its Long Term Refinancing Operations (LTROs) it loaned €489 billion to 523 banks for an exceptionally long period of three years at a rate of just one per cent. Previous refinancing operations matured after three, six, and twelve months. The by far biggest amount of €325 billion was tapped by banks in Greece, Ireland, Italy and Spain.

This way the ECB tried to make sure that banks have enough cash to pay off €200 billion of their own maturing debts in the first three months of 2012, and at the same time keep operating and loaning to businesses so that a credit crunch does not choke off economic growth. It also hoped that banks would use some of the money to buy government bonds, effectively easing the debt crisis. On 29 February 2012, the ECB held a second auction, LTRO2, providing 800 eurozone banks with further €529.5 billion in cheap loans. Net new borrowing under the €529.5 billion February auction was around €313 billion; out of a total of €256 billion existing ECB lending (MRO + 3m&6m LTROs), €215 billion was rolled into LTRO2.