Moral hazard facts for kids

Moral hazard is a term used in economics. Nobel laureate Paul Krugman explains moral hazard as "any situation in which one person makes the decision about how much risk to take, while someone else bears the cost if things go badly."

In other words, a "moral hazard" is a situation where the possible costs of a risky action are not borne by the one taking the risk.

- Example: A person buys insurance against automobile theft. After buying the protection against this kind of loss, the same person may be less cautious about locking his or her car. If so, this is a kind of moral hazard. The expected consequences of vehicle theft are now partly the responsibility of the insurance company. Will the person show the same degree of care in locking the car regardless of whether there is insurance or insurance policy?

"Moral hazard" is a kind of reverse incentive (perverse incentive).

Contents

History

The term "moral hazard" was first used in the 17th century. The "moral" in "moral hazard" was understood to mean "subjective". It was not used in a way that has anything to do with ethics.

In the 1960s, economists used the term to describe inefficiencies that occur because of information asymmetry. In economics, "moral hazard" as a special kind of market failure.

Related pages

- PBS.org, Frontline: "Inside the Meltdown"

Images for kids

-

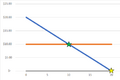

The blue line represents the downward sloping marginal benefit curve. The orange line represents the constant $10 marginal cost curve without insurance. The green star is the market equilibrium. When the individual is insured, the marginal cost curve shifts down to 0, leading to a new equilibrium at the yellow star.

See also

In Spanish: Riesgo moral para niños

In Spanish: Riesgo moral para niños