Economic impact of the COVID-19 pandemic facts for kids

The COVID-19 pandemic caused far-reaching economic consequences including the COVID-19 recession, the second largest global recession in recent history, decreased business in the services sector during the COVID-19 lockdowns, the 2020 stock market crash (which included the largest single-week stock market decline since the financial crisis of 2007–2008), the impact of COVID-19 on financial markets, the 2021–2023 global supply chain crisis, the 2021–2023 inflation surge, shortages related to the COVID-19 pandemic including the 2020–present global chip shortage, panic buying, and price gouging. The pandemic led to governments providing an unprecedented amount of stimulus, and was also a factor in the 2021–2022 global energy crisis and 2022–2023 food crises.

The pandemic affected worldwide economic activity, resulting in a 7% drop in global commercial commerce in 2020. Several demand and supply mismatches caused by the pandemic resurfaced throughout the recovery period in 2021 and 2022 and were spread internationally through trade. During the first wave of the COVID-19 pandemic, businesses lost 25% of their revenue and 11% of their workforce, with contact-intensive sectors and SMEs being particularly heavily impacted. However, considerable policy assistance helped to avert large-scale bankruptcies, with just 4% of enterprises declaring for insolvency or permanently shutting at the time of the COVID-19 wave.

Amidst the recovery and containment, the world economic system was characterized as experiencing significant, broad uncertainty. Economic forecasts and consensus among macroeconomics experts show significant disagreement on the overall extent, long-term effects and projected recovery. A large general increase in prices was attributed to the pandemic. In part, the record-high energy prices were driven by a global surge in demand as the world quit the economic recession caused by COVID-19, particularly due to strong energy demand in Asia.

Contents

- Background

- Overall economic contraction

- Population growth

- Financial markets

- Manufacturing

- The arts, entertainment and sport

- Medicine

- Publishing

- Retail

- E-commerce

- Restaurant sector

- Science and technology

- Tourism

- Events and institutions

- Transportation

- Unemployment

- Impact by gender

- Economic inequality

- See also

Background

The initial outbreak of the pandemic in China coincided with the Chunyun, a major travel season associated with the Chinese New Year holiday. A number of events involving large crowds were cancelled by national and regional governments, including annual New Year festivals, with private companies also independently closing their shops and tourist attractions such as Hong Kong Disneyland and Shanghai Disneyland. Many Lunar New Year events and tourist attractions were closed to prevent mass gatherings, including the Forbidden City in Beijing and traditional temple fairs. In 24 of China's 31 provinces, municipalities and regions, authorities extended the New Year's holiday to 10 February, instructing most workplaces not to re-open until that date. These regions represented 80% of the country's GDP and 90% of exports. Hong Kong raised its infectious disease response level to the highest and declared an emergency, closing schools until March and cancelling its New Year celebrations.

The demand for personal protection equipment has risen 100-fold, according to WHO director-general Tedros Adhanom. This demand has led to an increase in prices of up to twenty times the normal price and also induced delays on the supply of medical items for four to six months.

Overall economic contraction

The COVID-19 recession is an economic recession happening across the world economy beginning in 2020 due to the COVID-19 pandemic. Global stock markets experienced their worst crash since 1987, and in the first three months of 2020 the G20 economies fell 3.4% year-on-year. Between April and June 2020, the International Labour Organization estimated that an equivalent of 400 million full-time jobs were lost across the world, and income earned by workers globally fell 10 percent in the first nine months of 2020, equivalent to a loss of over US$3.5 trillion. Cambridge University put the cost to the global economy at $82 trillion over five years. When the COVID-19 pandemic hit Europe, much of Europe's investment had been high, but it had unexpectedly slowed. In 2019, overall investment in the European Union increased by about 3% over the previous year, surpassing growth in real GDP.

Investment, like other economic activity, fell drastically as a direct result of lockdown restrictions. This effect was particularly noticeable in the second quarter of 2020, when investment decreased 19% year on year, as most limitations were relaxed by the summer. In 2019, firms already had an unfavorable assessment of the economic situation. Overall expectations for sector-specific business prospects, as well as the availability of internal and external funding, deteriorated in the course of 2020.

In the European Investment Bank Investment report 2020–21, 81% of the respondents cited uncertainty as the most severe obstacle to investment. 20% of EU companies anticipate a permanent loss in employment, indicating that a sizable proportion of firms are pessimistic about their capacity to "bounce back" once the COVID-19 crisis has passed.

As a result of the pandemic, half of European companies anticipate an increase in the usage of digital technologies in the future. The proportion is considerably greater among companies that have previously used digital technology.

The European Union's public debt is expected to exceed 95% of GDP by the end of 2021, a 15 percentage point rise since the pandemic began in 2019.

From the first to the second quarter of 2020, the EU government debt grew by 8.4 percentage points to 88% of GDP. According to the European Commission, debt to GDP reached 94% by the end of 2020. In autumn 2020, a second wave of infection and lockdowns aggravated the problem.

After one year of the COVID-19 crisis, corporate investment was expected to decline by at least 25%.

The International Monetary Fund (IMF) and other organizations predicted that the European Union's GDP would contract by 6% to 8%, a drop unprecedented since the Great Depression.

The European Union's total real GDP fall was more than 11% compared to the first quarter of 2020, the biggest drop in a single quarter on record.

The reduction in GDP was caused by government attempts to restrict the virus's spread, and it varied greatly between Member States. It was weakest, on average, in Central and Eastern Europe, where real GDP decreased 9.7% in the second quarter compared to the first. It decreased by 11.5% in Western and Northern Europe, and by roughly 15% in Southern Europe. In comparison, real GDP in the United States fell by nearly 9% in the second quarter compared to the first quarter.

In the second quarter of 2020, disposable income per capita decreased dramatically, affecting consumer expenditure, particularly for lower-income families.

The impact of the COVID-19 varied greatly on the industry. Sectors that rely heavily on physical presence, including passenger transportation, the arts, entertainment, tourism, and hospitality, were impacted the worst, with declines of up to 30% in the second quarter of 2020 compared to the first quarter. Industries such as agriculture, banking, and real estate, declined by 3% or less during the same time span. During the global financial crisis, the distribution of economic effect across sectors was extremely varied, with EU manufacturing suffering the worst decrease – over 20% in the first quarter of 2009. The decrease in other sectors was relatively limited, at around or below 6%.

GDP per hour in the EU grew by 0.3 percent in the second quarter of 2020 compared to the same time in 2019, while GDP per employee decreased 11.5%. Access to capital is seen as a barrier by about 55% of businesses. Credit limitations are especially difficult for SMEs and new businesses to overcome. Credit constraints affect 24% of SMEs and 27% of young businesses.

More than two-fifths of businesses (44%) did not experience a year-on-year sales loss as a result of COVID-19 at the time of the European Investment Bank's investment survey, and more than half predicted stronger sales in 2022 than before the pandemic.

In Western and Northern Europe, as well as Central and Eastern Europe, the unemployment rate climbed by roughly 0.5 percentage point. The rise was greater in Southern Europe (1.5 percentage points). The United States increased by 4 percentage points during the same period, reaching a high of 10 percentage points in April in 2021.

44% of enterprises in Central, Eastern and Southeastern European countries incurred losses in 2020 and/or 2021, and 10% did not anticipate to recover from pandemic-era economic losses in 2022. 60% of CESEE enterprises received some type of financial assistance in response to COVID-19, which is the same as the EU average. This was largely in the form of subsidies or other types of non-repayable financial assistance. Only around one out of every ten businesses reports that they are still receiving financial assistance in 2023.'

All sectors received support during the COVID-19 crisis, primarily through subsidies. In 2022, energy-intensive Industries had the highest share of firms (22%) still receiving support. Energy-intensive industries and renewables saw the strongest recovery post-pandemic, with sales increased by 76% and 72%, from 2020 to 2021. Other sectors in the EU also experienced significant turnover growth post-COVID-19.

In Europe, the hardest hit sector by the COVID-19 pandemic was electronics, due to semiconductor shortages. The digital sector was overall least affected by trade disruptions from COVID-19.

Economic recovery programmes

Nations, cities and other collectives with governance mechanisms worldwide have announced the development and implementation of programmes for guided economic recovery. Some economic recovery programmes include Next Generation EU and Pandemic Emergency Purchase Programme.

A study published in August 2020 concluded that the direct effect of the response to the pandemic on global warming will likely be negligible and that a well-designed economic recovery could avoid future warming of 0.3 °C by 2050. The study indicates that systemic change for decarbonization of humanity's economic structures is required for a substantial impact on global warming, which also has economic aspects. Beyond targeted financing of green projects or sectors, contemporary decision-making mechanisms also allow for excluding projects with substantial environmental, social, or climate risks from financial relief. Over 260 civil society organizations called on Chinese actors to ensure that COVID-19 related Belt and Road Initiative funding excludes such projects. In November 2020 the IMF said that governments and central banks had promised $19.5 trillion of support since the coronavirus began.

The United Nations Environment Programme analyzed $14.6 trillion of global spending in 2020, and found that only 2.5% was directed towards tackling climate change, advising governments to "make use of recovery spending to steer away from the worst impacts of climate change and inequality". A 2022 analysis of G20 country spending found that about 6% of their pandemic recovery spending has been allocated to areas that will also cut greenhouse-gas emissions, including electrifying vehicles, making buildings more energy efficient and installing renewables.

The IMF estimates that, in September, G20 governments committed some $15 trillion in fiscal resources: $7 trillion in direct budget support and an additional $8 trillion in public sector borrowing and capital injections into corporations. This $15 trillion represented almost 14 percent of global GDP.

Population growth

COVID-19 increased mortality around the world, with the UN estimating that there were 15 million deaths due to COVID-19 in 2020 and 2021. This estimate was broadly in line with other estimates of 14.9 million from World Health Organization and 17.6 million from The Economist.

While COVID-19 increased mortality in general, different countries experienced dramatically different impacts on birth rate. Birth rates in the US declined, whereas Germany's reached an all-time monthly high. Some in China had initially thought that their COVID-19 lockdowns would boost birth rate, but that prediction was proven wrong.

US population growth fell to a record low of 0.1%. In Australia, overall population growth slowed dramatically due to decreased migration, however, births did not appear to be impacted dramatically.

Financial markets

Economic turmoil associated with the coronavirus pandemic has wide-ranging and severe impacts upon financial markets, including stock, bond and commodity (including crude oil and gold) markets. Major events included the Russia–Saudi Arabia oil price war that resulted in a collapse of crude oil prices and a stock market crash in March 2020. The United Nations Development Programme expects a US$220 billion reduction in revenue in developing countries, and expects COVID-19's economic impact to last for months or even years. Some expect natural gas prices to fall.

During the early phase of COVID in April and May, there was a significant correlation between the extent of the outbreak and volatility in financial and stock markets. The broader effects of this volatility impacted credit markets, and save for government interventions and central banks pursuing quantitative easing, would have led to more significant economic downturns.

Manufacturing

See also 2020–present global chip shortage.

2021 Car production crisis

New vehicle sales in the United States have declined by 40%. The American Big Three have all shut down their US factories. The German automotive industry came into the crisis after having already suffered from the Dieselgate-scandal, as well as competition from electric cars. Boeing and Airbus suspended production at some factories. A survey conducted by the British Plastics Federation (BPF) explored how COVID-19 is impacting manufacturing businesses in the United Kingdom (UK). Over 80% of respondents anticipated a decline in turnover over the next 2 quarters, with 98% admitting concern about the negative impact of the pandemic on business operations. In July 2021, car production in the United Kingdom hit lowest level since 1956.

The arts, entertainment and sport

The epidemic had a sudden and substantial impact on the arts and cultural heritage (GLAM) sectors worldwide. The global health crisis and the uncertainty resulting from it profoundly affected organisations' operations as well as individuals – both employed and independent – across the sector. By March 2020, across the world most cultural institutions had been indefinitely closed (or at least with their services radically curtailed) exhibitions, events and performances cancelled or postponed. Many individuals temporarily or permanently lost contracts or employment with varying degrees of warning and financial assistance available. Equally, financial stimulus from governments and charities for artists, have provided greatly differing levels of support, depending on the sector and the country. In countries such as Australia, where the arts contributed to about 6.4% of GDP, effects on individuals and the economy have been significant.

Cinema

The pandemic has impacted the film industry. Across the world and to varying degrees, cinemas have been closed, festivals have been cancelled or postponed, and film releases have been moved to future dates. As cinemas closed, the global box office dropped by billions of dollars, while streaming became more popular and the stock of Netflix rose; the stock of film exhibitors dropped dramatically. Almost all blockbusters to be released after the March opening weekend were postponed or cancelled around the world, with film productions also halted. Massive losses in the industry have been predicted.

Sport

Most major sporting events were cancelled or postponed, including the 2020 Summer Olympics in Tokyo, which were postponed on 24 March 2020 until 2021.

Television

The COVID-19 pandemic has shut down or delayed production of television programs in several countries. However, a joint report from Apptopia and Braze showed a 30.7% increase in streaming sessions worldwide on platforms such as Disney+, Netflix, and Hulu during the month of March.

Video games

The pandemic also affected the video game sector to a smaller degree. As the outbreak appeared in China first, supply chains affected the manufacturing and production of some video game consoles, delaying their releases and making current supplies scarcer. As the outbreak and pandemic spread, several keystone trade events, including E3 2020, were cancelled over concerns of further spread. The economic impact on the video game sector is not expected to be as large as in film or other entertainment sectors as much of the work in video game production can be decentralised and performed remotely, and products distributed digitally to consumers regardless of various national and regional lockdowns on businesses and services.

Medicine

The pandemic led to a boom in medicine-related elements such as plastic surgery.[1]

Publishing

The pandemic is predicted to have a dire effect on local newspapers in the United States, where many were already severely struggling beforehand.

In light of the public health situation in which includes afflicted regions where retail sectors deemed non-essential have been ordered closed for the interim, Diamond Comic Distributors announced on 24 March 2020 a full suspension of distributing published material and related merchandise as 1 April 2020 until further notice. As Diamond has a near-monopoly on printed comic book distribution, this is described as an "extinction-level event" that threatens to drive the entire specialized comic book retail sector out of business with that one move. As a result, publishers like IDW Publishing and Dark Horse Comics have suspended publication of their periodicals while DC Comics is exploring distribution alternatives including an increased focus on online retail of digital material.

Total US book sales went down by 8.4% in March 2020 compared to March 2019 after the stay-at-home orders were implemented, with bookstore sales dropping by an estimated 33%. By June 2020, demand began to recover with the exception of educational material and bookstore sales, with most sales going to Amazon and big-box stores, who were open since they were considered essential businesses. Books that were initially supposed to be published in spring and early summer were delayed until fall, with the expectation that the pandemic would be over by then. Two of the major printing companies, Quad and LSC Communications, faced financial issues into the latter half of the year as the latter declared bankruptcy during a rise in demand. Increased sales were attributed to major book releases and increased demand for children's books. This created supply chain bottleneck at the printing process for most publishers. According to NPD BookScan, print sales went up almost 8% in 2020.

Retail

The pandemic has impacted the retail sector. Shopping centres around the world responded by reducing hours or closing down temporarily. As of 18 March 2020, the footfall to shopping centres fell by up to 30%, with significant impact in every continent. Additionally, product demand exceeded supply for many consumables, resulting in empty retail shelves. In Australia, the pandemic has provided a new opportunity for daigou shoppers to re-sell into the China market. "The virus crisis, while frightening, has a silver lining".

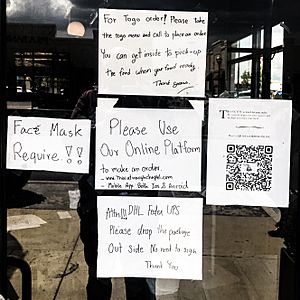

Some retailers have employed contactless home delivery or curbside pickup for items purchased through e-commerce sites. By April, retailers had started implementing "retail to go" models where consumers could pick up their orders. An estimated 40% of shoppers were shopping online and choosing to pick up in-store, a behavior that had suddenly doubled as compared to the previous year.

Small-scale farmers have been embracing digital technologies as a way to directly sell produce, and community-supported agriculture and direct-sell delivery systems are on the rise.

In mid-April, Amazon confirmed that workers at over half of its 110 U.S. warehouses had been diagnosed with coronavirus.

On 16 June, the United States Department of Commerce announced that retail sales for the month of May had seen an increase of 17.7% from April as states began to reopen and lift restrictions. According to CNBC, This marks the biggest one month jump in the history of retailing in the United States. Numbers for June reflected a 7.5 percent rise in sales.

Business closures

By April, department store retailers JCPenney, Nordstrom, Macy's and Kohl's had lost $12.3 billion combined in market caps. Neiman Marcus and JCPenney defaulted on bond payments in April, preparing internally for bankruptcy court and bankruptcy protection. J.Crew and Neiman Marcus filed for bankruptcy during the first week of May; they were reportedly the first two major retailers to do so during the pandemic. JCPenney filed for bankruptcy on 15 May.

In May, Pier 1 announced it would close as soon as possible. It had sought court protection in February and had hoped that someone would buy the business, but the subsequent recession made this seem unlikely.

In early 2021, Family Video announced all their remaining stores would be liquidated and closed down.

E-commerce

The pandemic boosted e-commerce sales. With more people staying at home, both by choice as well as through government lockdowns, there was a decline in brick-and-mortar shopping. On the other hand, e-commerce surged 34% during 2020, and in 2021 surpassed levels not expected until 2025, projected to reach $843 billion in the US in 2021.

Despite persistent cross-country differences, the Covid crisis has enhanced dynamism within the e-commerce landscape across countries and has dilated the scope of e-commerce, as well as through new firms, client segments (e.g. elderly) and product (e.g. groceries).

The pandemic has created a shift in the manner shoppers behave and perform their activities, directly moving the e-commerce industry so the prosperity of e-commerce during pandemic lockdown has increased significantly.

The impact of the epidemic on transportation and production has affected e-commerce. Customers will consider whether goods can be shipped on time and delivered on time, and these factors will affect their choices. Under the current epidemic conditions, some online sellers, taking advantage of the characteristics of e-commerce, are defrauding consumers. The problems and flaws exposed by these e-merchants in the epidemic situation further push e-merchants towards a more mature and regulated path.

Social media plays a huge role, Facebook and own e-commerce web sites of e-commerce firms are the foremost growing sales channels since the start of the COVID-19 crisis.

Global e-commerce sales are expected to reach $6.5 trillion by 2023, up from $3.5 trillion in 2019.

Restaurant sector

The pandemic has impacted the restaurant business. In the beginning of March 2020, some major cities in the US announced that bars and restaurants would be closed to sit-down dinners and limited to takeout orders and delivery. Later in the month, many states put in place restrictions that required restaurants to be takeout or delivery only. Some employees were fired, and more employees lacked sick leave in the sector compared to similar sectors. With only carry-out and delivery services, most servers and bartenders were laid off, prompting these employees creating "virtual tip jars" across 23 U.S. cities. In the United States, an initiative known as the "Great American Takeout" called on people under quarantine to support local restaurants each Tuesday by ordering takeout for curbside pickup or using food delivery services. It began in late March 2020.

Science and technology

The pandemic impacted productivity of science, space and technology projects. Space agencies including NASA and the European Space Agency halted production of the Space Launch System, James Webb Space Telescope, and put space science probes into hibernation or low power mode and shifted to remote work. Various IT companies had launched several programs to sustain in this pandemic and in this new normal life. The pandemic may have improved scientific communication or established new forms of it. For instance a lot of data is being released on preprint servers and is getting dissected on social Internet platforms and sometimes in the media before entering formal peer review. Scientists are reviewing, editing, analyzing and publishing manuscripts and data at record speeds and in large numbers. This intense communication may have allowed an unusual level of collaboration and efficiency among scientists.

Tourism

Philia Tounta summarised likely effects of COVID-19 on global tourism early in March 2020:

- severe effects because tourism depends on travel

- quarantine restrictions

- fear of airports and other places of mass gathering

- fears of illness abroad

- issues with cross-border medical insurance

- tourism enterprise bankruptcies

- tourism industry unemployment

- airfare cost increases

- damage to the image of the cruise industry

Events and institutions

The pandemic has caused the cancellation or postponement of major events around the world. Some public venues and institutions have closed.

Transportation

Staffing issues caused transportation bottlenecks in trucking and at ports in developed countries. Supply problems and sudden demand for socially-distanced recreation and alternatives to public transport caused a shortage of bicycles in the United States.

The cruise ship industry has also been heavily affected by a downturn, with the share prices of the major cruise lines down 70–80%.

In many of the world's cities, planned travel went down by 80–90%.

Aviation

The pandemic has had a significant impact on the aviation industry due to the resulting travel restrictions as well as a slump in demand among travellers. Significant reductions in passenger numbers have resulted in planes flying empty between airports and the cancellation of flights.

United States passenger airlines can expect about $50 billion in subsidies from the Coronavirus Aid, Relief, and Economic Security Act.

Cruise lines

Cruise lines had to cancel sailings after the outbreak of the COVID-19 pandemic. Bookings and cancellations grew as extensive media coverage of ill passengers on quarantined ships hurt the industry's image.

Shares of cruise lines fell sharply in value on 27 March 2020 when the $2 trillion Coronavirus Aid, Relief, and Economic Security Act excluded companies that are not "organized" under United States law. Senator Sheldon Whitehouse (D-RI) tweeted: "The giant cruise companies incorporate overseas to dodge US taxes, flag vessels overseas to avoid US taxes and laws, and pollute without offset. Why should we bail them out?" Senator Josh Hawley (R-MO) tweeted that cruise lines should register and pay taxes in the United States if they expect a financial bailout. U.S-based employees and small, American-owned companies are eligible for financial assistance.

Railways

Several rail operators had to receive state aid and/or reduced their scheduled services. Deutsche Bahn received billions of € in federal aid to cover record losses.

Unemployment

The International Labour Organization stated on 7 April that it predicted a 6.7% loss of job hours globally in the second quarter of 2020, equivalent to 195 million full-time jobs. They also estimated that 30 million jobs were lost in the first quarter alone, compared to 25 million during the Great Recession. The effects of COVID-19 on unemployment lasted much longer than was initially expecting. Almost 18 months after the start of the pandemic, the state of New York was still down almost a quarter of the jobs that were available in the hospitality industry pre-pandemic. This was the largest percent in any state in the United States, but other states still faced a similar issue.

In January and February 2020, during the height of the epidemic in Wuhan, about 5 million people in China lost their jobs. Many of China's nearly 300 million rural migrant workers have been stranded at home in inland provinces or trapped in Hubei province.

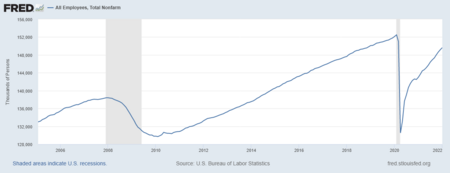

In March 2020, more than 10 million Americans lost their jobs and applied for government aid. Total nonfarm jobs fell from a high of 152.5 million in February 2020 to 130.2 million in April. As of February 2021[update], the US had about 143 million nonfarm jobs.

The lockdown in India has left tens of millions of migrant workers unemployed.

The survey from the Angus Reid Institute found that 44% of Canadian households have experienced some type of job loss.

Nearly 900,000 workers lost their jobs in Spain since it went into lockdown in mid-March 2020. During the second half of March, 4 million French workers applied for temporary unemployment benefits and 1 million British workers applied for a universal credit scheme.

Almost half a million companies in Germany have sent their workers on a government-subsidized short-time working schemes known as Kurzarbeit. The German short-time work compensation scheme has been copied by France and Britain.

The potential combined impact of COVID-19 on unemployment, households’ purchasing power, food prices, and food availability in local markets could severely jeopardize access to food in the most vulnerable countries.

Impact by gender

Around the world, women generally earn less and save less, are the majority of single-parent households and disproportionately hold more insecure jobs in the informal economy or service sector with less access to social protections. This leaves them less able to absorb the economic shocks than men. For many families, school closures and social distancing measures have increased the unpaid care and domestic load of women at home, making them less able to take on or balance paid work. The situation is worse in developing economies, where a larger share of people are employed in the informal economy in which there are far fewer social protections for health insurance, paid sick leave and more. Although globally informal employment is a greater source of employment for men (63 per cent) than for women (58 per cent), in low and lower-middle income countries a higher proportion of women are in informal employment than men. Unlike previous crisis', the COVID-19 pandemic affected more women dominated industries rather than male dominated industries: women were in the forefront in the fight against COVID-19 as most healthcare workers are women.

In Sub-Saharan Africa, for example, around 92 per cent of employed women are in informal employment compared to 86 per cent of men. It is likely that the pandemic could result in a prolonged dip in women's incomes and labour force participation. The ILO estimates global unemployment to rise between 5.3 million ("low" scenario) and 24.7 million ("high" scenario) from a base level of 188 million in 2019 as a result of COVID-19's impact on global GDP growth. By comparison, global unemployment went up by 22 million during the Great Recession. Women informal workers, migrants, youth and the world's poorest, among other vulnerable groups, are more susceptible to lay-offs and job cuts. For example, UN Women survey results from Asia and the Pacific are showing that women are losing their livelihoods faster than men and have fewer alternatives to generate income. And, in the U.S., men's unemployment went up from 3.55 million in February to 11 million in April in 2020 while women's unemployment – which was lower than men's before the crisis – went up from 2.7 million to 11.5 million over the same period, according to the U.S. Bureau of Labor Statistics. The picture is even bleaker for young women and men aged 16–19, whose unemployment rate jumped from 11.5 per cent in February to 32.2 per cent in April.

In Japan, women have been disproportionately hit by the Covid pandemic because sectors like retail and hospitality employ many women and have been heavily affected by the pandemic recession.

Economic inequality

Since most of the workforce who preserved their jobs had the option of switching to an online modality, and the online workforce is considerably higher paid on average, the pandemic exacerbated income inequality by hitting harder on low-paid workers.

Additionally, the global rise in extreme poverty rates during the pandemic further compounded these issues of economic inequality. According to the March 2024 update from the Poverty and Inequality Platform (PIP), the global extreme poverty rate increased from 8.9% in 2019 to 9.7% in 2020, marking the first rise in decades. This increase was largely due to significant job losses and reduced income among the lowest earners, particularly in regions like South Asia where extreme poverty rose by 2.4 percentage points. Although some regions experienced a decline in poverty due to effective fiscal policies, such as in Brazil, the overall global trend indicates a widening gap between the economically vulnerable and those able to maintain or enhance their financial stability during the pandemic.

See also

- Contactless payment

- Distance learning

- Financial market impact of the COVID-19 pandemic

- Remote work

- Shortages related to the COVID-19 pandemic