Toronto-Dominion Bank facts for kids

|

|

Toronto-Dominion Centre in downtown Toronto

|

|

|

Trade name

|

TD Bank Group |

|---|---|

| Public | |

| Traded as | |

| ISIN | ISIN: [https://isin.toolforge.org/?language=en&isin=CA8911605092 CA8911605092] |

| Industry | Financial services |

| Predecessors |

|

| Founded | February 1, 1955 |

| Headquarters | |

|

Key people

|

Bharat Masrani (CEO) |

| Services | Commercial banking |

| Revenue | |

| AUM | |

| Total assets | |

| Total equity | |

|

Number of employees

|

103,762 (FTE, 2023) |

| Divisions | TD Canada Trust |

| Subsidiaries |

|

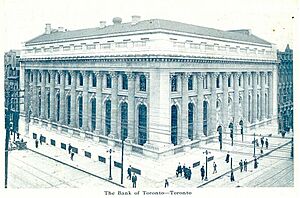

Toronto-Dominion Bank (French: Banque Toronto-Dominion), doing business as TD Bank Group (French: Groupe Banque TD), is a Canadian multinational banking and financial services corporation headquartered in Toronto, Ontario. The bank was created on February 1, 1955, through the merger of the Bank of Toronto and The Dominion Bank, which were founded in 1855 and 1869, respectively. It is one of two Big Five banks of Canada founded in Toronto, the other being the Canadian Imperial Bank of Commerce.

In 2021, according to Standard & Poor's, TD Bank Group was the largest bank in Canada by total assets and also by market capitalization, a top 10 bank in North America, and the 23rd largest bank in the world. In 2019, it was designated a global systemically important bank by the Financial Stability Board. In 2023, the company was ranked 43rd in the Forbes Global 2000.

The bank and its subsidiaries have over 89,000 employees and over 26 million clients worldwide. In Canada, the bank operates through its TD Canada Trust division and serves more than 11 million customers at over 1,091 branches. In the United States, the company operates through their subsidiary TD Bank, N.A., which was created through the merger of TD Banknorth and Commerce Bank. TD Bank serves more than 6.5 million customers in the United States with a network of over 1,200 branches in 16 states and the District of Columbia.

Contents

History

The predecessors of the Toronto-Dominion Bank, the Bank of Toronto, and The Dominion Bank were established in the mid-19th century, the former in 1855 and the latter in 1869. In 1954, an agreement was reached between the Bank of Toronto and The Dominion Bank to merge the two financial institutions. The merger was later accepted by the Canadian Minister of Finance on November 1, 1954, and was made official on February 1, 1955. The new institution adopted the name Toronto-Dominion Bank.

In 1967, TD Bank opened its new head office, the Toronto-Dominion Centre in downtown Toronto. In the next year, the bank entered into a partnership with Chargex (later known as Visa Inc.). The TD Bank shield logo was unveiled to the public near the end of the decade, in 1969.

In 1976, TD Bank piloted its first automated teller machine (ATM), the TD 360, which was renamed The Green Machine, a name it continues to carry.

In 1987, Toronto Dominion Securities Inc. was established by the bank. TD Bank saw growth in the 1990s, with the acquisition of several financial assets including the commercial branches of Standard Chartered Bank of Canada. In 1992, the bank acquired the assets and branches of Central Guaranty Trust, as well as Waterhouse Investor Services in 1996.

In 1992, TD Bank and G4S Cash Solutions, a subsidiary of British security services company G4S plc, began a pilot project in Toronto that developed into a nationwide partnership in 1997. G4S Cash Solutions secured the contract to transport cash and provide first-line maintenance for the bank's ATMs – both cash dispensing and deposit pick up units." By 2010, the partnership had expanded where G4S Cash Solutions operated 2,577 ATMs, 1,093 branch night deposits, 95 weekly balanced cash dispensers as well as eight cash dispensers for branch tellers and 100 across the pavement services and hosted a discussion on the introduction of polymer banknotes in 2011 with leading Canadian financial institutions.

TD Bank formed a partnership with Bank of Montreal (BMO) and Royal Bank of Canada (RBC) in 1996 to create Symcor, a private entity that offers transaction services such as item processing, statement processing and cash-management services to major banks and retail and telecommunications companies in Canada. In 2011, Symcor produces close to 675 million statements and more than two billion pages of customer statements, and processes three billion cheques annually.

In 1998, TD Bank and the Canadian Imperial Bank of Commerce agreed to a merger. However, the Government of Canada, at the recommendation of then Minister of Finance Paul Martin, blocked the merger, as well as another proposed merger between the Bank of Montreal and the Royal Bank of Canada – believing it was not in the best interest of Canadians.

In 2000, Toronto-Dominion Securities bought Newcrest Capital for CA$224 million (75 per cent in stock and 25 per cent in cash). In the same year, TD Bank also acquired Canada Trust, re-branding most of its commercial banking operations in Canada as TD Canada Trust.

Ultimately Martin would approve the merger of TD and Canada Trust with some conditions. The new bank sold Canada Trust's MasterCard business to meet the demands of the Competition Bureau due to the fact that TD issued Visa cards at the time and Canada Trust issued MasterCard and competition rules at the time prevented a single institution from the duality of selling both brands simultaneously. The Competition Bureau also forced the sale of 13 branches, representing over 120,000 customers, in three Ontario markets where the territories of TD and Canada Trust overlapped. The vast majority of the affected branches were in the Kitchener-Waterloo area, including four in Kitchener, two in Waterloo, four in Cambridge and one in Elmira. All but one branch were sold to the Bank of Montreal for $50 million. The remaining branch in Paris, Ontario, was sold to Laurentian Bank of Canada. In all six TD branches and seven Canada Trust branches specifically changed hands to meet the Competition Bureau's requirements.

In response, TD announced it would close 275 branches, representing 4,900 employees, to adhere to the ruling and to reduce overall costs. The Canadian Federation of Independent Business said the Competition Bureau's decision to ultimately approve the deal would reduce consumer choice while eliminating the chance to create a second-tier of Canadian banking by killing off the Trust industry in Canada.

21st century

In 2002, TD Bank acquired Stafford Trading and Letco Trading. In the following year, TD Bank acquired Laurentian Bank's retail branches west of Quebec.

In 2004, TD Bank entered the American retail banking market, announcing an agreement to acquire the majority stake of Banknorth, a New England–based bank, for a total of US$3.8 billion. Banknorth was later rebranded as TD Banknorth after the sale was finalized in March 2005.

In January 2006, the company sold its United States brokerage business branded as TD Waterhouse, which it had purchased in 1984, to Ameritrade. The business was renamed TD Ameritrade.

In April 2007, TD Bank acquired all remaining shares of TD Banknorth, transforming TD Banknorth into a fully owned subsidiary of TD Bank, and resulting in it being no longer traded on the New York Stock Exchange. In the same year, TD Bank acquired Commerce Bancorp, a bank based in Cherry Hill, New Jersey. Commerce Bancorp was later merged with TD Banknorth to form TD Bank, N.A. in 2008.

In 2010, the bank acquired the Florida-based Riverside National Bank of Fort Pierce; and the South Financial Group Inc. In the following year, TD Bank acquired Chrysler Financial, which was later rebranded as TD Auto Finance. On December 1, 2011, TD Bank acquired MBNA's Canadian credit card business. In October 2014, Affiliated Computer Services, a subsidiary of Xerox, acquired Symcor's U.S. operations from TD Bank.

After Moody's Investor Service downgraded the credit worthiness of Royal Bank of Canada to Aa1 on December 13, 2010, TD Bank remained the only one of Canada's Big Five banks with a top Aaa credit rating at that point in the Great Recession (at the time, CIBC was Aa2, Scotiabank was Aa1 and Bank of Montreal was Aa2). It is also ranked number 1 by profit in the Top 1000 2012 listing.

From 2014 to 2015, TD went through a minor restructuring which included job cuts and other cost-cutting measures, under the leadership of Bharat Masrani, which kept the stock price on a stable upward trend.

In April 2020 it became apparent that TD Bank was a significant secured creditor involved in the voluntary administration of the Virgin Australia airline, which has debts of A$7 billion. The Virgin administrators declared TD Bank held an all present and after-acquired property charge over substantially the whole of the property of certain entities of the airline.

In March 2021, TD Bank agreed to buy Headlands Tech Global Markets LLC from Headlands Technologies to enhance its automated fixed income trading platform.

Bloomberg reported that TD Bank, along with Canada's other large banks, added ESG measures to their chief executive officers' compensation plans.

On February 28, 2022, TD made a US$13.4 billion offer for First Horizon Corp., with 1,159 branches, expected to be completed in February 2023. This would be the second-largest bank deal since the Great Recession in the United States. As of December 31, 2021, TD had US$423.65 billion in U.S. assets, making it the ninth largest bank in the United States. If completed the deal would give TD 1,560 branches in 22 U.S. states. On May 4, 2023, it was announced that the deal would not proceed due to regulatory uncertainty.

In July 2022, TD Bank announced it was evaluating a takeover of US brokerage firm Cowen. The following month, TD agreed to buy Cowen for US$1.3 billion in an all-cash deal, paying Cowen shareholders US$39 per share. TD announced that Cowen chair and CEO Jeffrey Solomon would join the senior leadership of TD's securities division following the acquisition, and that the combined business will be known as TD Cowen, headed by Solomon. To fund the purchase, TD sold over 28 million non-voting common shares of Charles Schwab Corporation, reducing its stake in the company from 13.4 percent to 12 percent.

In August 2023, TD Bank Group announced that it was expanding its share repurchase program. It planned to repurchase 90 million shares (about 4.9 percent of outstanding shares).

Sponsorships

Toronto-Dominion Bank, and its subsidiaries, are title sponsors for a number of sporting venues in Canada and the United States. TD Bank holds the naming rights to several multi-sport indoor arenas, including TD Garden in Boston, Massachusetts. TD Banknorth acquired the naming rights for the Boston-based venue in 2005, with the venue being known as TD Banknorth Garden until 2007. After TD Banknorth was merged to form TD Bank, N.A., the venue dropped Banknorth from the name and was branded as TD Garden. The Boston Celtics and Boston Bruins, which play at the venue, announced a 20-year extension of the TD Garden naming rights deal in January 2023. The deal extends to 2045.

Other indoor stadiums sponsored by TD Bank include TD Station in Saint John, New Brunswick; and TD Place Arena in Ottawa, Ontario. TD Place Arena forms a part of TD Place at Lansdowne Park. The bank also holds the naming rights to the outdoor stadium at TD Place, known as TD Place Stadium. Other outdoor stadiums sponsored by TD Bank include TD Stadium in London, Ontario, and TD Ballpark in Dunedin, Florida.

See also

In Spanish: Toronto-Dominion Bank para niños

In Spanish: Toronto-Dominion Bank para niños

- List of banks and credit unions in Canada

- List of banks in the Americas

- List of largest banks