Sotheby's facts for kids

|

|

|

|

| Private | |

| Industry | Fine arts, rare objects |

| Founded | 11 March 1744 in London, England |

| Founder | Samuel Baker |

| Headquarters | 1334 York Avenue,

New York City

,

U.S.

|

|

Number of locations

|

80 locations in 40 countries (as of 2021) |

|

Area served

|

Worldwide |

|

Key people

|

Charles F. Stewart (CEO) |

| Services | Auctions, financial services |

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Owner | Patrick Drahi |

|

Number of employees

|

|

| Subsidiaries | Sotheby's Institute of Art, Sotheby's International Realty, RM Sotheby's |

Sotheby's (/ˈsʌðəbiz/ sudh-Ə-beez) is a British-founded multinational corporation with headquarters in New York City. It is one of the world's largest brokers of fine and decorative art, jewellery, and collectibles. It has 80 locations in 40 countries, and maintains a significant presence in the UK.

Sotheby's was established on 11 March 1744 in London by Samuel Baker, a bookseller. In 1767 the firm became Baker & Leigh, after George Leigh became a partner, and was renamed to Leigh and Sotheby in 1778 after Baker's death when Leigh's nephew, John Sotheby, inherited Leigh's share. Other former names include: Leigh, Sotheby and Wilkinson; Sotheby, Wilkinson and Hodge (1864–1924); Sotheby and Company (1924–83); Mssrs Sotheby; Sotheby & Wilkinson; Sotheby Mak van Waay; and Sotheby's & Co.

The American holding company was initially incorporated in August 1983 in Michigan as Sotheby's Holdings, Inc. In June 2006, it was reincorporated in the State of Delaware and was renamed Sotheby's. In June 2019, Sotheby's was acquired by French-Israeli businessman Patrick Drahi at a 61% market premium.

Sotheby's Institute of Art (an educational facility), Sotheby's International Realty (real estate dealers), and RM Sotheby's (classic car dealers) are subsidiaries or partner organisations.

Contents

History

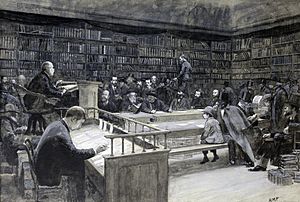

Beginnings (18th & 19th century)

Sotheby's was established on 11 March 1744 in London by Samuel Baker, a bookseller. In 1767 the firm became Baker & Leigh, after Samuel Baker auctioned several hundred valuable books from the library of The Rt Hon Sir John Stanley, 1st Baronet, of Grangegorman and became business partners with George Leigh. The library Napoleon took with him into exile at St Helena, as well as the library collections of John Wilkes, Benjamin Heywood Bright and the Dukes of Devonshire and of Buckingham (both related to George Leigh), were sold through Samuel Baker's auctions.

After Baker's death in 1778, the business was left to Leigh and his nephew John Sotheby, where it became a prominent book auction house and was renamed Leigh and Sotheby.

George Leigh died in 1816, but not before recruiting Samuel E Leigh into the business. Under the Sotheby family, the auction house extended its activities to auctioning prints, medals, and coins. John Wilkinson, Sotheby's senior accountant, became a partner and eventually the company's new head of the company when the last member of the Sotheby family died in 1861.

20th century

The business did not seek to auction fine arts initially. Their first major success in this field was the sale of a Frans Hals painting for nine thousand guineas in 1913. Other former names include: Leigh, Sotheby and Wilkinson; Sotheby, Wilkinson and Hodge (1864–1924); Sotheby and Company (1924–83); Mssrs Sotheby; Sotheby & Wilkinson; Sotheby Mak van Waay; and Sotheby's & Co. In 1917, Sotheby's relocated from 13 Wellington Street to 34–35 New Bond Street, which remains as its London base. They soon came to rival Christie's as leaders of the London auction market, which capitalised on the arts.

In 1964, Sotheby's purchased Parke-Bernet, the largest auctioneer of fine art in the United States at the time. In the following year, Sotheby's moved to 980 Madison Avenue, New York. With the international fine art auction industry growing, Sotheby's opened offices in Paris and Los Angeles in 1967, and became the first auction house to operate in Hong Kong in 1973, and Moscow in 1988.

As well as numerous high-profile real-life auctions being held at Sotheby's, the firm's auctioneers have also been used in various films, including the 1983 James Bond film Octopussy.

With private transactions constituting an essential and increasingly profitable business segment, through the years Sotheby's has bought art galleries and helped dealers finance purchases. It has also gone into partnership with dealers on private sales. In 1990, Sotheby's teamed up with dealer William Acquavella, to form Acquavella Modern Art, a Nevada general partnership and a subsidiary of Sotheby's Holding Company. The subsidiary paid $143 million for the contents of the Pierre Matisse Gallery in Manhattan, which included about 2,300 works by artists including Miró, Jean Dubuffet, Alberto Giacometti, and Marc Chagall, and began selling the works both at auction and privately.

In 1996, Sotheby's acquired Andre Emmerich Gallery to operate a division called Emmerich/Sotheby's, As a consequence, the Josef and Anni Albers Foundation, the main beneficiary of the artists' estates, as well as the estates of Morris Louis and Milton Avery announced that they would not renew their Emmerich contracts. That decision came right after it was disclosed that Sotheby's had decided to close Emmerich's prime space at 41 East 57th Street, and that its artists would be handled out of Deitch Projects. Sotheby's subsequently closed Andre Emmerich in 1998.

In 1997, Sotheby's purchased a 50% interest in Deitch Projects but later sold its share back to Jeffrey Deitch. In 1997, it also bought Leslie Hindman Auctioneers in Chicago; by 2001, it stopped holding auctions in the city.

In 2006, Sotheby's acquired a Dutch dealership, Noortman Master Paintings, from its owner, Robert Noortman, for $82.5 million ($56.5 million worth of Sotheby's stock and assumption of more than $26 million in gallery debt, including $11.7 million owed to the auction house). Sotheby's and Noortman had collaborated before in 1995, when the sales of Dutch plastic millionaire Joost Ritman were divided between the two companies. Already in 1990, Sotheby's New York had successfully lobbied for a zoning change permitting the construction of a 27-story residential tower above the five-story headquarters; this expansion was never realised. Instead, Sotheby's throughout the 1990s expressed interest in sites that ranged from the old Alexander's building on East 59th Street to the New York Coliseum site on Columbus Circle, and was even considering moving into the old B. Altman Building on Fifth Avenue.

21st century

The company eventually bought its York Avenue building for $11 million in 2000 and completed a $140 million expansion and renovation in 2001, adding six floors and 240,000 square feet. The renovation added the capability to store works on the same premises as the specialist departments, galleries, and auction spaces. Sotheby's New York's offices also house Sotheby's Wine and the former Bid (an American contemporary restaurant and later bistro), which was closed due to poor attendance. The company sold the building in 2002 for $175 million. In May 2007, Sotheby's opened an office in Moscow in response to rapidly growing interest among Russian buyers in the international art market and held sales in Qatar in 2009.

As many industries took a blow from the economic crisis of 2008, the art market also saw a contraction. In international figures, art prices fell by 7.5% in Q1 of 2008 in comparison to the previous quarter. In September and October 2008, major auction houses saw a sharp decline in sales: artprice.com, the world leader in art market information, coined the term "Black October". Sotheby's bought-in rate was 27%, Christie's was 45% and Phillips de Pury's was 46%. However, the total values of global and United States Fine Art auction sales were US$8.3 billion and US$2.9 billion, respectively. In 2009, art collector Steven A. Cohen built a 6 percent stake in the auction house for his hedge fund SAC Capital Advisors.

In 2011, Noortman's Amsterdam space was closed and the gallery moved to London. Two years later, Sotheby's closed Noortmans, after having written down $8.3 million of inventory and started selling off lower-valued works of art through other auction houses. As of 2021[update], Sotheby's is present in over 40 countries, with 80 locations. In 2012, the company signed a 10-year joint-venture agreement to form Sotheby's (Beijing) Auction Co. Ltd., the first international auction house in China; under the agreement, it invested $1.2 million to take an 80 percent stake in the venture with state-owned Beijing Gehua Cultural Development Group.

As of 2012, the firm had an annual revenue of approximately US$831.8 million and offices on Manhattan's York Avenue and London's New Bond Street.

Sotheby's shares a rivalry with Christie's for the position of the world's pre-eminent fine art auctioneer, a title of much subjectivity. In August 2004, Sotheby's introduced an online system – MySotheby's – allowing clients to track lots and create "wishlists" that could be automatically updated as new works became available. Sotheby's also created the BIDnow service, which allows bidders to bid real-time online while watching the broadcast auctions, with the exception of Wine auctions. LiveBid is Sotheby's online bidding system exclusively for wine auctions.

In the meantime, income from classic auctioneering has fallen, as Sotheby's reported a decrease of 42% in net income in the first half of 2012.

In February 2015 Sotheby's acquired a 25% stake in classic and vintage automobile auctioneer RM Auctions.

In March 2015, Tad Smith, former president and chief executive of New York's Madison Square Garden, succeeded William F. Ruprecht as CEO of Sotheby's. Smith had no experience in the auction industry but had overseen a doubling of profits during his time at Madison Square Garden. In 2015, the auction house's longest-serving auctioneer, David Redden, and vice-chairman retired.

In 2016, the company spent $50 million on Art Agency Partners, run by Amy Cappellazzo, Allan Schwartzman and Adam Chinn. The price was shared among the trio, as well as $35 million performance-related bonus. The five-year contract expired in 2021.

In July 2016, Chinese insurance company Taikang Life became Sotheby's largest shareholder, with a 13.5% stake.

On 25 January 2018, Sotheby's acquired the AI company Thread Genius for an undisclosed amount.

In February 2019, Sotheby's announced a redesign and expansion of its New York headquarters on the Upper East Side that is being led by the designer Shohei Shigematsu of the Office for Metropolitan Architecture (OMA). The exhibition space there will grow to over 90,000 square feet from 67,000, and the project will include the addition of several new galleries. The company also launched a new online bidding platform on its website.

In June 2019, Sotheby's was acquired by French-Israeli businessman Patrick Drahi at a 61% market premium. In October 2019, he brought in Charles F. Stewart as Sotheby's new CEO, and former CEO Tad Smith transitioned to an advisory role. Drahi instituted a number of cost-cutting measures, including senior executive layoffs in 2019; job cuts, salary cuts, and a move to online auctions during the 2020 pandemic; and announcing an end to Sotheby's employee pension plan in 2022.

In 2020, Sotheby's overtook Christie's as the world's top auction house for the first time since 2011, with over $5 billion in aggregate sales compared to its rival's $4.4 billion.

As of late 2021, Drahi's son, Nathan Drahi, was the managing director of Sotheby's Asia.

In June 2023, Sotheby's agreed to purchase 945 Madison Avenue, a former museum building designed by Marcel Breuer, to house the company's headquarters, including its galleries, exhibition space, and auction room. The company plans to open its new space in 2025.

History of public and private ownership

Sotheby's became a UK public company in 1977. In 1980, after a drop in sales, Sotheby's relocated its North American headquarters from Madison Avenue to a former cigar factory at 1334 York Avenue, New York. In 1982, the auction house closed its Madison Avenue galleries at East 76th Street, and its Los Angeles galleries were sold and West Coast auctions moved to New York.

In 1983, a group of investors including American millionaire Alfred Taubman purchased and privatized Sotheby's. Sotheby's was initially incorporated as Sotheby's Holdings, Inc. in Michigan in August 1983.

In 1988, Taubman took Sotheby's public and listed the company's shares on the New York Stock Exchange, making Sotheby's the oldest publicly traded company on the NYSE under the ticker symbol "BID". In June 2006, Sotheby's Holdings, Inc. reincorporated in the State of Delaware and was renamed Sotheby's shortly after.

In 2019 Sotheby's was acquired by Patrick Drahi for $3.7 billion, becoming again a private company and no longer trading on the New York Stock Exchange.

Auction process

Sotheby's auctions are usually held during the day. The majority are free and open to the public, with the exception of occasional evening auctions, which require tickets. Attendees have no obligation to bid.

Bidding finishes when only one bidder remains willing to purchase the lot at the bidder's declared price. The auctioneer "knocks down" the lot, declaring it sold to the winning bidder. The winning bid for a lot is also called the hammer price. Sotheby's organises the delivery of the lot in private with the buyer.

Buying

Buyers can find out what is for sale at Sotheby's by browsing e-catalogues, visiting pre-sale exhibitions, purchasing print catalogues and registering for e-mail alerts. Buyers can register to bid in person at Sotheby's offices, or online. Sotheby's requires that prospective buyers provide government-issued proof of identity and sometimes a bank reference. There are four ways buyers can bid: in person at the auction rooms, by telephone, bid live online or make an absentee bid online. When a bid is successful, Sotheby's calculates and sums the hammer price, the buyer's premium and taxes.

Selling

Sellers are required to submit an Auction Estimate Form, providing thorough information and a photograph of the item. Once accepted for auction, the seller and Sotheby's sign a contract, which sets out the reserve price and the seller's commission. If bidding on a seller's lot does not reach the reserve price, the item is not sold.

Service categories

As of April 2021[update], Sotheby's listed the following services:

- Advisory

- Fiduciary client group

- Global partnerships

- Financial services/lending

- Fine art storage

- Post sale services

- Private sales

- Restitution

- Scientific research

- Tax, heritage and UK museums

- Valuations

- Wine advisory services

- Private sales

Sotheby's links sellers with prospective buyers in private if sellers do not want a public auction. The identities of buyers and consignors are not disclosed. Sotheby's Private Sales works with clients with confidentiality and tailors the buying and selling process in a private setting. Private Sales accounted for 16.5% of all Sotheby's sales in 2011. That year, Sotheby's inaugurated a new gallery space called S2 at its York Avenue headquarters with a show of work by American abstract painter Sam Francis. Unlike Haunch of Venison, a gallery that Christie's bought in 2007, S2 is solely devoted to showcasing the auction house's private sales. In 2013, Sotheby's opened a gallery for private sales close to its branch in London, in a five-story block at 31 George Street. The auction house also conducts private sales through its selling exhibitions of monumental sculpture at Chatsworth House, Derbyshire, and at the Singapore Botanic Gardens.

- Financial services

Established in 1988, Sotheby's Financial Services offers loans for consigned property and loans against the value of client's items through customized terms. The auction house also makes term loans, for a defined period of time, on works that clients aren't planning to sell, in part to "establish or enhance mutually beneficial relationships with borrowers" that can lead to future consignments. While traditional lenders such as banks provide loans at a lower cost to borrowers, Sotheby's said in its 2011 annual report, few will accept works of art as the sole collateral.

- Picture library

Sotheby's Picture Library contained images in a variety of formats available for licensing, and was one of the image suppliers to various databases such as the British Association of Picture Libraries and Agencies (BAPLA). However, only the image archive mentioned on the Sotheby's website as of April 2021[update] is an out-of-date reference to the Cecil Beaton Studio Archive, which Cecil Beaton sold to Sotheby's in 1977.

- Wine

In October 2019, Sotheby's launched Sotheby's Own Label Collection, a line of a dozen wines. The project took two years to complete, and is based on Sotheby's best-selling wines, both those represented in-store and on its e-commerce platform. Additionally, the collection reflects some of the long-standing relationships Sotheby's has with producers around the world. The Sotheby's Wine Encyclopedia has been published in several editions since 1988, written by Tom Stevenson.

- Other

Sotheby's has produced a bimonthly online magazine since November–December 2018, Sotheby's Magazine.

Partners and subsidiaries

Sotheby's Institute of Art

In 1969, Sotheby's founded Sotheby's Institute of Art in London. The Institute now offers full-time accredited master's degrees as well as a range of online and other courses.

Sotheby's International Realty

Sotheby's International Realty is a luxury real estate brand founded in 1976 by Sotheby's. It operates as a franchise.

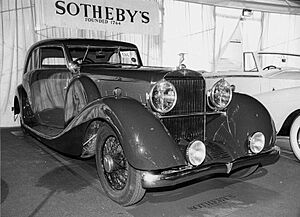

RM Sotheby's

RM Sotheby's deals in classic cars, headquartered in Canada with offices across the US and Europe. Formerly RM Auctions, the company has been part-owned by Sotheby's since 2015.

Sotheby's Prize

The Sotheby's Prize, launched in 2017, is a $250,000 annual award given to museums that exhibit what are vaguely described as "groundbreaking shows". The inaugural winners were Many Tongues: Art, Language and Revolution in the Middle East and South Asia curated by Omer Kholeif of the Museum of Contemporary Art in Chicago and Pop América: Contesting Freedom, 1965–1975 curated by Esther Gabara of the Nasher Museum. The Sotheby's Prize program concluded in 2020, following a promise to honor existing commitments to shows that are still in formation.

Notable sales

Auctioned artwork

Sotheby's has set, then later reset, a number of world records for auctioned works of art. The following monetary values are given in United States dollars.

- On 22 May 2002, Norman Rockwell's painting of Rosie the Riveter was sold for $4.96 million.

- On 3 May 2006, Sotheby's auctioned Pablo Picasso's Dora Maar au Chat for $95 million, becoming the second-most-expensive artwork ever sold at auction at that time.

- On 7 June 2007, a Roman-era bronze sculpture of Artemis and the Stag was sold at Sotheby's for $28.6 million, setting the new record as the most expensive sculpture as well as work from antiquity ever sold at auction at that time.

- Sotheby's holds the world record for most expensive piece of contemporary art ever sold at auction, with Mark Rothko's 1950 White Center (Yellow, Pink and Lavender on Rose), grossing $72.8 million in May 2007.

- Sotheby's set a new world record, at that time, for the most expensive auctioned work by a living artist, bringing in $17 million at a November 1986 auction of Out the Window by Jasper Johns, the first auction over $10 million in this category.

- While Sotheby's and Christie's surpassed each other over time, Sotheby's reclaimed the record with the first auction over $20 million in this category, Jeff Koons' Hanging Heart (Magenta/Gold), which grossed $23.6 million in a November 2007 sale.

- Sotheby's retook this record, at that time, on 12 October 2012, with the first auction over $30 million in this category, when a 1994 painting from the Abstraktes Bilder series by Gerhard Richter, Abstraktes Bild (809–4), was sold for $34 million.

- On 6 December 2007, Sotheby's auctioned the Guennol Lioness, a 31⁄4-inch limestone lion from ancient Mesopotamia. It is thought to be at least 5,000 years old. It was sold for $57 million, fetching the highest price ever paid for at an auction for a sculpture.

- On 15 December 2007, Sotheby's auctioned one of only seven copies of The Tales of Beedle the Bard, written by J. K. Rowling. The book was purchased for a hammer price of $3.8 million. Each leather bound copy was hand written and illustrated by Rowling, with six given to her close friends and the seventh sent to auction with proceeds going to The Children's Voice charity.

- On 19 December 2007, Sotheby's auctioned a 710-year-old copy of Magna Carta, the last remaining copy in private hands out of the 17 that are known to exist. The copy sold for $21.3 million.

- On 3 February 2010, the sculpture L'Homme qui marche I by Alberto Giacometti sold for $103.7 million at a London auction, at that time setting a new world record for a work of art sold at auction.

- On 2 May 2012, a version of the painting The Scream was sold for $119.9 million.

- On 11 November 2014, the Patek Philippe Henry Graves Supercomplication became the most expensive watch ever sold at auction, reaching a final price of $23.98 million in Geneva.

- On 2 June 2016, Pablo Picasso's Femme Assise sold for $63.7 million at Sotheby's in London, making it the most expensive Cubist painting ever sold at auction.

- On 10 July 2018, E. H. Shepard's original 1926 illustrated map of the Hundred Acre Wood, which features in the opening pages of A. A. Milne's Winnie-the-Pooh, sold for £430,000 ($600,000) in London, setting a record for a book illustration.

- On 5 October 2018, Banksy's "Girl with a Balloon" began to 'shred' itself shortly after hammering down at the artist's auction record. The work was later sold again with the new title "Love is in the Bin" for £18.5 million, an artist's record for Banksy after the previous record of £16.5 million set in March that year.

- On 14 May 2019, Claude Monet's Meules was sold for over $110 million.

- On 25 October 2021, Sotheby's auctioned 11 Picasso's previously belonging to Steve Wynn for $109 million in a pop-up salesroom in Las Vegas.

- On 6 September 2023, Freddie Mercury's Yamaha baby grand piano, which he used to compose "Bohemian Rhapsody" among other Queen songs, sold for £1.7 million ($2.1 million), which Sotheby's state is a record for a composer's piano. The month-long exhibition in London, Freddie Mercury: A World of His Own, saw almost 1,500 items of Mercury's sold across six auctions, taking in a total £39.9 million ($50.4 million) and surpassing a previous mark set by David Bowie.

Sneaker sales

In recent years, Sotheby's has been selling sneakers, both vintage designs in a "buy-now" sneaker shop, and high-value pairs, some worn by famous people, by auction. Sneaker auctions have brought in large numbers new to Sotheby's, from as young as 19 years old and across the world. Notable auction record-breaking sales include:

- July 2019, Nike 1972 Nike Waffle Racing Flat "Moon Shoe", US$437,500

- 17 May 2020, Michael Jordan's autographed Nike "Air Jordan 1"s from 1985 sold for US$560,000

- April 2021, Nike Air Yeezy 1 worn by Kanye West at the 2008 Grammy Awards, US$1.8 million. This was the first pair of sneakers reported anywhere selling for more than US$1 million. They were bought by the specialist sneaker-investing platform RARES.

Jewelry

On 9 July 2021, Sotheby's sold a 101.38-carat diamond for $12.3 million in cryptocurrency. The sale became the most expensive physical object ever publicly offered for purchase with cryptocurrency at the time.

See also

In Spanish: Sotheby's para niños

In Spanish: Sotheby's para niños

- Love is in the Bin, Banksy painting sold by Sotheby's in 2018 and then again in 2021

- Peter Wilson (auctioneer), former chairman

- The Sotheby's Wine Encyclopedia