Sale of UK gold reserves, 1999–2002 facts for kids

The sale of UK gold reserves was a policy pursued by HM Treasury over the period between 1999 and 2002, when gold prices were at their lowest in 20 years, following an extended bear market. The period itself has been dubbed by some commentators as the Brown Bottom or Brown's Bottom.

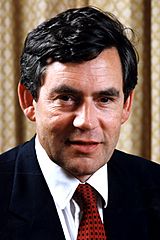

The period takes its name from Gordon Brown, the Chancellor of the Exchequer, who decided to sell approximately half of the UK's gold reserves in a series of auctions. At the time, the UK's gold reserves were worth about US$6.5 billion, accounting for about half of the UK's US$13 billion foreign currency net reserves. There are various later estimates of the cost of that the decision to British taxpayers, for example £2 billion (The Sunday Times, 2007) and £7 billion (The Daily Telegraph, 2010).

Events

The UK government's intention to sell gold and reinvest the proceeds in foreign currency deposits, including euros, was announced on 7 May 1999, when the price of gold stood at US$282.40 per ounce (cf. the price in 1980: $850/oz ) The official stated reason for this sale was to diversify the assets of the UK's reserves away from gold, which was deemed to be too volatile. However, many critics believe that the decision to invest 40% of the gold sale proceeds into euro denominated assets was to show public support for the new euro currency. The gold sales funded a like-for-like purchase of financial instruments in different currencies. Studies performed by HM Treasury had shown that the overall volatility of the UK's reserves could be reduced by 20% from the sale.

The advance notice of the substantial sales drove the price of gold down by 10% by the time of the first auction on 6 July 1999. With many gold traders shorting, gold reached a low point of US$252.80 on 20 July. The UK eventually sold about 395 tonnes (12,700,000 ozt) of gold over 17 auctions from July 1999 to March 2002, at an average price of about US$275 per ounce, raising approximately US$3.5 billion.

To deal with this and other prospective sales of gold reserves, a consortium of central banks - including the European Central Bank and the Bank of England - were pushed to sign the Washington Agreement on Gold in September 1999, limiting gold sales to 400 tonnes (13,000,000 ozt) per year for 5 years. This triggered a sharp rise in the price of gold, from around US$260 per ounce to around $330 per ounce in two weeks, before the price fell away again into 2000 and early 2001. The Central Bank Gold Agreement was renewed in 2004 and 2009.

See also

- Gold as an investment