Meta Platforms facts for kids

Logo used since 2021

|

|||

Headquarters in Menlo Park, California

|

|||

|

Trade name

|

Meta | ||

|---|---|---|---|

|

Formerly

|

|

||

| Public | |||

| Traded as |

|

||

| Industry |

|

||

| Founded | January 4, 2004 in Cambridge, Massachusetts, U.S. | ||

| Founders |

|

||

| Headquarters |

,

U.S.

|

||

|

Area served

|

Worldwide | ||

|

Key people

|

|||

| Products | |||

| Revenue | |||

|

Operating income

|

|||

| Total assets | |||

| Total equity | |||

| Owner | Mark Zuckerberg (13.68% equity; 61.2% voting) | ||

|

Number of employees

|

69,329 (Mar. 2024) | ||

| Divisions | Reality Labs | ||

| Subsidiaries | Novi Financial | ||

|

|||

Meta Platforms, Inc., doing business as Meta, and formerly named Facebook, Inc., and TheFacebook, Inc., is an American multinational technology conglomerate based in Menlo Park, California. The company owns and operates Facebook, Instagram, Threads, and WhatsApp, among other products and services. Meta ranks among the largest American information technology companies, alongside other Big Five corporations Alphabet (Google), Amazon, Apple, and Microsoft. The company was ranked #31 on the Forbes Global 2000 ranking in 2023.

Meta has also acquired Oculus (which it has integrated into Reality Labs), Mapillary, CTRL-Labs, and a 9.99% stake in Jio Platforms; the company additionally endeavored into non-VR hardware, such as the discontinued Meta Portal smart displays line and presently partners with Luxottica through the Ray-Ban Stories series of smartglasses. Despite endeavors into hardware, the company relies on advertising for a vast majority of its revenue, amounting to 97.8 percent in 2023.

Parent company Facebook, Inc. rebranded as Meta Platforms, Inc. on October 28, 2021, to "reflect its focus on building the metaverse", an integrated environment linking the company's products and services.

Contents

History

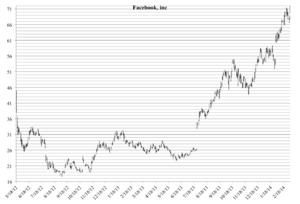

Facebook filed for an initial public offering (IPO) on January 1, 2012. The preliminary prospectus stated that the company sought to raise $5 billion, had 845 million monthly active users, and a website accruing 2.7 billion likes and comments daily. After the IPO, Zuckerberg would retain 22% of the total shares and 57% of the total voting power in Facebook.

Underwriters valued the shares at $38 each, valuing the company at $104 billion, the largest valuation to date for a newly public company. On May 16, one day before the IPO, Facebook announced it would sell 25% more shares than originally planned due to high demand. The IPO raised $16 billion, making it the third-largest in US history (slightly ahead of AT&T Mobility and behind only General Motors and Visa). The stock price left the company with a higher market capitalization than all but a few U.S. corporations—surpassing heavyweights such as Amazon, McDonald's, Disney, and Kraft Foods—and made Zuckerberg's stock worth $19 billion. The New York Times stated that the offering overcame questions about Facebook's difficulties in attracting advertisers to transform the company into a "must-own stock". Jimmy Lee of JPMorgan Chase described it as "the next great blue-chip". Writers at TechCrunch, on the other hand, expressed skepticism, stating, "That's a big multiple to live up to, and Facebook will likely need to add bold new revenue streams to justify the mammoth valuation."

Trading in the stock, which began on May 18, was delayed that day due to technical problems with the Nasdaq exchange. The stock struggled to stay above the IPO price for most of the day, forcing underwriters to buy back shares to support the price. At the closing bell, shares were valued at $38.23, only $0.23 above the IPO price and down $3.82 from the opening bell value. The opening was widely described by the financial press as a disappointment. The stock nonetheless set a new record for trading volume of an IPO. On May 25, 2012, the stock ended its first full week of trading at $31.91, a 16.5% decline.

On May 22, 2012, regulators from Wall Street's Financial Industry Regulatory Authority announced that they had begun to investigate whether banks underwriting Facebook had improperly shared information only with select clients rather than the general public. Massachusetts Secretary of State William F. Galvin subpoenaed Morgan Stanley over the same issue. The allegations sparked "fury" among some investors and led to the immediate filing of several lawsuits, one of them a class action suit claiming more than $2.5 billion in losses due to the IPO. Bloomberg estimated that retail investors may have lost approximately $630 million on Facebook stock since its debut. S&P Global Ratings added Facebook to its S&P 500 index on December 21, 2013.

On May 2, 2014, Zuckerberg announced that the company would be changing its internal motto from "Move fast and break things" to "Move fast with stable infrastructure". The earlier motto had been described as Zuckerberg's "prime directive to his developers and team" in a 2009 interview in Business Insider, in which he also said, "Unless you are breaking stuff, you are not moving fast enough."

2018–2020: Focus on the metaverse

Lasso was a short-video sharing app from Facebook similar to TikTok that was launched on iOS and Android in 2018 and was aimed at teenagers. On July 2, 2020, Facebook announced that Lasso would be shutting down on July 10.

In 2018, the Oculus lead Jason Rubin sent his 50-page vision document titled "The Metaverse" to Facebook's leadership. In the document, Rubin acknowledged that Facebook's virtual reality business had not caught on as expected, despite the hundreds of millions of dollars spent on content for early adopters. He also urged the company to execute fast and invest heavily in the vision, to shut out HTC, Apple, Google and other competitors in the VR space. Regarding other players' participation in the metaverse vision, he called for the company to build the "metaverse" to prevent their competitors from "being in the VR business in a meaningful way at all".

In May 2019, Facebook founded Libra Networks, reportedly to develop their own stablecoin cryptocurrency. Later, it was reported that Libra was being supported by financial companies such as Visa, Mastercard, PayPal and Uber. The consortium of companies was expected to pool in $10 million each to fund the launch of the cryptocurrency coin named Libra. Depending on when it would receive approval from the Swiss Financial Market Supervisory authority to operate as a payments service, the Libra Association had planned to launch a limited format cryptocurrency in 2021. Libra was renamed Diem, before being shut down and sold in January 2022 after backlash from Swiss government regulators and the public.

During the COVID-19 pandemic, the use of online services including Facebook grew globally. Zuckerberg predicted this would be a "permanent acceleration" that would continue after the pandemic. Facebook hired aggressively, growing from 48,268 employees in March 2020 to more than 87,000 by September 2022.

2021: Rebrand as Meta

Following a period of intense scrutiny and damaging whistleblower leaks, news started to emerge on October 21, 2021, about Facebook's plan to rebrand the company and change its name. In the Q3 2021 Earnings Call on October 25, Mark Zuckerberg discussed the ongoing criticism of the company's social services and the way it operates, and pointed to the pivoting efforts to building the metaverse – without mentioning the rebranding and the name change. The metaverse vision and the name change from Facebook, Inc. to Meta Platforms was introduced at Facebook Connect on October 28, 2021. Based on Facebook's PR campaign, the name change reflects the company's shifting long term focus of building the metaverse, a digital extension of the physical world by social media, virtual reality and augmented reality features.

"Meta" had been registered as a trademark in the United States in 2018 (after an initial filing in 2015) for marketing, advertising, and computer services, by a Canadian company that provided big data analysis of scientific literature. This company was acquired in 2017 by the Chan Zuckerberg Initiative (CZI), a foundation established by Zuckerberg and his wife, Priscilla Chan, and became one of their projects. Following the rebranding announcement, CZI announced that it had already decided to deprioritize the earlier Meta project, thus it would be transferring its rights to the name to Meta Platforms, and the previous project would end in 2022.

2022: Declining profits and mass layoffs

Soon after the rebranding, in early February 2022, Meta reported a greater-than-expected decline in profits in the fourth quarter of 2021. It reported no growth in monthly users, and indicated it expected revenue growth to stall. It also expected measures taken by Apple Inc. to protect user privacy to cost it some $10 billion in advertisement revenue, an amount equal to roughly 8% of its revenue for 2021. In meeting with Meta staff the day after earnings were reported, Zuckerberg blamed competition for user attention, particularly from video-based apps such as TikTok.

The 27% reduction in the company's share price which occurred in reaction to the news eliminated some $230 billion of value from Meta's market capitalization. Bloomberg described the decline as "an epic rout that, in its sheer scale, is unlike anything Wall Street or Silicon Valley has ever seen". Zuckerberg's net worth fell by as much as $31 billion. Zuckerberg owns 13% of Meta, and the holding makes up the bulk of his wealth.

According to published reports by Bloomberg on March 30, 2022, Meta turned over data such as phone numbers, physical addresses, and IP addresses to hackers posing as law enforcement officials using forged documents. The law enforcement requests sometimes included forged signatures of real or fictional officials. When asked about the allegations, a Meta representative said, "We review every data request for legal sufficiency and use advanced systems and processes to validate law enforcement requests and detect abuse." In June 2022, Sheryl Sandberg, the chief operating officer of 14 years, announced she would step down that year. Zuckerberg said that Javier Olivan would replace Sandberg, though in a "more traditional" role.

In March 2022, Meta (except Meta-owned WhatsApp) and Instagram were banned in Russia and added to Russian list of terrorist and extremist organizations for alleged Russophobia and hate speech(up to genocidal calls) amid ongoing Russian invasion of Ukraine. Meta appealed against the ban but it was upheld by a Moscow court in June of the same year.

Also in March 2022, Meta and Italian eyewear giant Luxottica released Ray-Ban Stories, a series of smartglasses which could play music and take pictures. Meta and Luxottica parent company EssilorLuxottica declined to disclose sales on the line of products as of September 2022, though Meta has expressed satisfaction with its customer feedback.

In July 2022, Meta saw its first year-on-year revenue decline when its total revenue slipped by 1% to $28.8bn. Analysts and journalists accredited the loss to its advertising business, which has been limited by Apple's app tracking transparency feature and the number of people who have opted not to be tracked by Meta apps. Zuckerberg also accredited the decline to increasing competition from TikTok. On October 27, 2022, Meta's market value dropped to $268 billion, a loss of around $700 billion compared to 2021, and its shares fell by 24%. It lost its spot among the top 20 US companies by market cap, despite reaching the top 5 in the previous year.

In November 2022, Meta laid off 11,000 employees, 13% of its workforce. Zuckerberg said the decision to aggressively increase Meta's investments had been a mistake, as he had wrongly predicted that the surge in e-commerce would last beyond the COVID-19 pandemic. He also attributed the decline to increased competition, a global economic downturn and "ads signal loss". Plans to lay off a further 10,000 employees began in April 2023. The layoffs were part of a general downturn in the technology industry, alongside layoffs by companies including Google, Amazon, Tesla, Snap, Twitter and Lyft.

2023–present: Threads, AI and all-time high stock value

In March 2023, Meta announced a new round of layoffs that would cut 10,000 employees and close 5,000 open positions in order to make the company more efficient. Meta revenue surpassed analyst expectations for the first quarter of 2023 after announcing that it was increasing its focus on AI. On July 6, Meta launched a new app, Threads, a competitor to Twitter.

Meta announced its artificial intelligence model Llama 2 in July 2023, available for commercial use via partnerships with major cloud providers like Microsoft. It was the first project to be unveiled out of Meta's generative AI group after it was set up in February. It would not charge access or usage but instead operate with an open-source model to allow Meta to ascertain what improvements need to be made. Prior to this announcement, Meta said it had no plans to release Llama 2 for commercial use. An earlier version of Llama was released to academics.

In August 2023, Meta announced its permanent removal of news content from Facebook and Instagram in Canada due to the Online News Act, which requires Canadian news outlets to be compensated for content shared on its platform. The Online News Act was in effect by year-end, but Meta will not participate in the regulatory process. In October 2023, Zuckerberg said that AI would be Meta's biggest investment area in 2024. Meta finished 2023 as one of the best-performing technology stocks of the year, with its share price up 150 percent. Its stock reached an all-time high in January 2024, bringing Meta within 2% of achieving $1 trillion market capitalization.

Meta Platforms launched an ad-free service in Europe in November 2023, allowing subscribers to opt-out of personal data being collected for targeted advertising. A group of 28 European organizations, including Max Schrems' advocacy group NOYB, the Irish Council for Civil Liberties, Wikimedia Europe, and the Electronic Privacy Information Center, signed a 2024 letter to the European Data Protection Board (EDPB) expressing concern that this subscriber model would undermine privacy protections, specifically GDPR data protection standards.

Meta removed the Facebook and Instagram accounts of Iran's Supreme Leader Ali Khamenei in February 2024, citing repeated violations of its Dangerous Organizations & Individuals policy.

Mergers and acquisitions

Meta has acquired multiple companies (often identified as talent acquisitions). One of its first major acquisitions was in April 2012, when it acquired Instagram for approximately US$1 billion in cash and stock. In October 2013, Facebook, Inc. acquired Onavo, an Israeli mobile web analytics company. In February 2014, Facebook, Inc. announced it would buy mobile messaging company WhatsApp for US$19 billion in cash and stock. Later that year, Facebook bought Oculus VR for $2.3 billion in cash and stock, which released its first consumer virtual reality headset in 2016. In late November 2019, Facebook, Inc. announced the acquisition of the game developer Beat Games, responsible for developing one of that year's most popular VR games, Beat Saber. In Late 2022 after Facebook Inc rebranded to Meta Platforms Inc, Oculus was rebranded to Meta Quest.

In May 2020, Facebook, Inc. announced it had acquired Giphy for a reported cash price of $400 million. It will be integrated with the Instagram team. However, in August 2021, UK's Competition and Markets Authority (CMA) stated that Facebook, Inc. might have to sell Giphy, after an investigation found that the deal between the two companies would harm competition in display advertising market. Facebook, Inc. was fined $70 million by CMA for deliberately failing to report all information regarding the acquisition and the ongoing antitrust investigation. In October 2022, the CMA ruled for a second time that Meta be required to divest Giphy, stating that Meta already controls half of the advertising in the UK. Meta agreed to the sale, though it stated that it disagrees with the decision itself. In May 2023, Giphy was divested to Shutterstock for $53 million.

In November 2020, Facebook, Inc. announced that it planned to purchase the customer-service platform and chatbot specialist startup Kustomer to promote companies to use their platform for business. It has been reported that Kustomer valued at slightly over $1 billion. The deal was closed in February 2022 after regulatory approval.

In September 2022, Meta acquired Lofelt, a Berlin-based haptic tech startup.

Lobbying

In 2020, Facebook, Inc. spent $19.7 million on lobbying, hiring 79 lobbyists. By 2019, it had spent $16.7 million on lobbying and had a team of 71 lobbyists, up from $12.6 million and 51 lobbyists in 2018. Facebook was the largest spender of lobbying money among the Big Tech companies in 2020. The lobbying team includes top congressional aide John Branscome, who was hired in September 2021, to help the company fend off threats from Democratic lawmakers and the Biden administration.

Disinformation concerns

In 2024 Meta's decision to continue to disseminate a falsified video of President Biden, even after it had been proven to be fake, attracted criticism and concern. AI-generated deepfakes spreading through Meta platforms was identified as a growing problem.

Structure

Management

Meta's key management consists of:

- Mark Zuckerberg, chairman and chief executive officer

- Javier Olivan, chief operating officer

- Sir Nick Clegg, president, global affairs

- Susan Li, chief financial officer

- Andrew Bosworth, chief technology officer

- David Wehner, chief strategy officer

- Chris Cox, chief product officer

- Jennifer Newstead, chief legal officer

As of October 2022[update], Meta had 83,553 employees worldwide.

Board of directors

As of February 2024, Meta's board consisted of the following directors;

- Mark Zuckerberg (chairman, co-founder, controlling shareholder, and chief executive officer)

- Sheryl Sandberg (non-executive director and former chief operating officer)

- Peggy Alford (non-executive director, executive vice president, global sales, PayPal)

- Marc Andreessen (non-executive director, co-founder and general partner, Andreessen Horowitz)

- Drew Houston (non-executive director, chairman and chief executive officer, Dropbox)

- Nancy Killefer (non-executive director, senior partner, McKinsey & Company)

- Robert M. Kimmitt (non-executive director, senior international counsel, WilmerHale)

- Tracey Travis (non-executive director, executive vice president, chief financial officer, Estée Lauder Companies)

- Tony Xu (non-executive director, chairman and chief executive officer, DoorDash)

- Hock Tan (CEO of Broadcom)

- John D. Arnold (former Enron executive)

Company governance

Roger McNamee, an early Facebook investor and Zuckerberg's former mentor, said Facebook had "the most centralized decision-making structure I have ever encountered in a large company".

Facebook co-founder Chris Hughes has stated that chief executive officer Mark Zuckerberg has too much power, that the company is now a monopoly, and that, as a result, it should be split into multiple smaller companies. In an op-ed in The New York Times, Hughes said he was concerned that Zuckerberg had surrounded himself with a team that did not challenge him, and that it is the U.S. government's job to hold him accountable and curb his "unchecked power". He also said that "Mark's power is unprecedented and un-American." Several U.S. politicians agreed with Hughes. European Union Commissioner for Competition Margrethe Vestager stated that splitting Facebook should be done only as "a remedy of the very last resort", and that it would not solve Facebook's underlying problems.

Revenue

| Year | Revenue | Growth |

|---|---|---|

| 2004 | $0.4 | — |

| 2005 | $9 | 2150% |

| 2006 | $48 | 433% |

| 2007 | $153 | 219% |

| 2008 | $280 | 83% |

| 2009 | $775 | 177% |

| 2010 | $2,000 | 158% |

| 2011 | $3,711 | 86% |

| 2012 | $5,089 | 37% |

| 2013 | $7,872 | 55% |

| 2014 | $12,466 | 58% |

| 2015 | $17,928 | 44% |

| 2016 | $27,638 | 54% |

| 2017 | $40,653 | 47% |

| 2018 | $55,838 | 37% |

| 2019 | $70,697 | 27% |

| 2020 | $85,965 | 22% |

| 2021 | $117,929 | 37% |

| 2022 | $116,609 | -1% |

| 2023 | $134,902 | 16% |

Facebook ranked No. 34 in the 2020 Fortune 500 list of the largest United States corporations by revenue, with almost $86 billion in revenue most of it coming from advertising. One analysis of 2017 data determined that the company earned US$20.21 per user from advertising.

According to New York, since its rebranding, Meta has reportedly lost $500 billion as a result of new privacy measures put in place by companies such as Apple and Google which prevents Meta from gathering users' data.

Number of advertisers

In February 2015, Facebook announced it had reached two million active advertisers, with most of the gain coming from small businesses. An active advertiser was defined as an entity that had advertised on the Facebook platform in the last 28 days. In March 2016, Facebook announced it had reached three million active advertisers with more than 70% from outside the United States. Prices for advertising follow a variable pricing model based on auctioning ad placements, and potential engagement levels of the advertisement itself. Similar to other online advertising platforms like Google and Twitter, targeting of advertisements is one of the chief merits of digital advertising compared to traditional media. Marketing on Meta is employed through two methods based on the viewing habits, likes and shares, and purchasing data of the audience, namely targeted audiences and "look alike" audiences.

Tax affairs

The US IRS challenged the valuation Facebook used when it transferred IP from the US to Facebook Ireland (now Meta Platforms Ireland) in 2010 (which Facebook Ireland then revalued higher before charging out), as it was building its double Irish tax structure. The case is ongoing and Meta faces a potential fine of $3–5bn.

The US Tax Cuts and Jobs Act of 2017 changed Facebook's global tax calculations. Meta Platforms Ireland is subject to the US GILTI tax of 10.5% on global intangible profits (i.e. Irish profits). On the basis that Meta Platforms Ireland Limited is paying some tax, the effective minimum US tax for Facebook Ireland will be circa 11%. In contrast, Meta Platforms Inc. would incur a special IP tax rate of 13.125% (the FDII rate) if its Irish business relocated to the US. Tax relief in the US (21% vs. Irish at the GILTI rate) and accelerated capital expensing, would make this effective US rate around 12%.

The insignificance of the US/Irish tax difference was demonstrated when Facebook moved 1.5bn non-EU accounts to the US to limit exposure to GDPR.

Facilities

Offices

Users outside of the US and Canada contract with Meta's Irish subsidiary, Meta Platforms Ireland Limited (formerly Facebook Ireland Limited), allowing Meta to avoid US taxes for all users in Europe, Asia, Australia, Africa and South America. Meta is making use of the Double Irish arrangement which allows it to pay 2–3% corporation tax on all international revenue. In 2010, Facebook opened its fourth office, in Hyderabad, India, which houses online advertising and developer support teams and provides support to users and advertisers. In India, Meta is registered as Facebook India Online Services Pvt Ltd. It also has support centers in Chittagong; Dublin; California; Ireland; and Austin, Texas.

Facebook opened its London headquarters in 2017 in Fitzrovia in central London. Facebook opened an office in Cambridge, Massachusetts in 2018. The offices were initially home to the "Connectivity Lab", a group focused on bringing Internet access to those who do not have access to the Internet. In April 2019, Facebook opened its Taiwan headquarters in Taipei.

In March 2022, Meta opened new regional headquarters in Dubai.

In September 2023, it was reported that Meta had paid £149m to British Land in order to break the lease on Triton Square London office. Meta reportedly had another 18 years left on its lease on the site.

-

Entrance to Meta's headquarters complex in Menlo Park, California

-

Entrance to Facebook's previous headquarters in the Stanford Research Park, Palo Alto, California

Data centers

As of 2023, Facebook operated 21 data centers. It committed to purchase 100% renewable energy and to reduce its greenhouse gas emissions 75% by 2020. Its data center technologies include Fabric Aggregator, a distributed network system that accommodates larger regions and varied traffic patterns.

See also

In Spanish: Meta Platforms para niños

In Spanish: Meta Platforms para niños

- Big Tech

- Criticism of Facebook

- Facebook–Cambridge Analytica data scandal

- 2021 Facebook leak

- Meta AI

- The Social Network