Central Bank of Ireland facts for kids

|

|

|

|

| Headquarters |

|

|---|---|

| Established | 1 February 1943 |

| Ownership | 100% state ownership |

| Governor | Gabriel Makhlouf (since September 2019) |

| Central bank of | Ireland |

| Reserves | 740 million USD |

| Preceded by | Currency Commission (currency control) Bank of Ireland (Government's banker)1 |

| 1 Even after establishment of the Central Bank, the Bank of Ireland remained the government's banker until 1 January 1972. 2 The Central Bank of Ireland still exists but many functions have been taken over by the ECB. |

|

The Central Bank of Ireland (Irish: Banc Ceannais na hÉireann) is the Irish member of the Eurosystem and has been the monetary authority for the Republic of Ireland from 1943 to 1998, issuing the Irish pound. It is also the country's main financial regulatory authority, and since 2014 has been Ireland's national competent authority within European Banking Supervision.

The Central Bank of Ireland was founded on 1 February 1943, and since 1 January 1972 has been the banker of the Government of Ireland in accordance with the Central Bank Act 1971, which can be seen in legislative terms as completing the long transition from a currency board to a fully functional central bank.

Its head office, the Central Bank of Ireland building, was located on Dame Street, Dublin from 1979 until 2017. Its offices at Iveagh Court and College Green also closed down at the same time. Since March 2017, its headquarters are located on North Wall Quay, where the public may exchange non-current Irish coinage and currency (both pre- and post-decimalization) for Euros, as well as high value Euro banknotes and "mutilated" currency. It also operates from premises at nearby Spencer Dock. The Currency Centre (Irish Mint) at Sandyford is the currency manufacture, warehouse and distribution site of the bank.

History

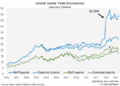

On the independence of the Irish Free State in 1922, the new state's trade was overwhelmingly with the United Kingdom (98% of Irish exports and 80% of imports in 1924), so the introduction of an independent currency was a low priority. British banknotes (British Treasury notes, Bank of England notes), and notes issued by Irish trading banks circulated (but only the first were legal tender) and British coins remained in circulation.

Under the terms of the Coinage Act 1926, the Finance Minister was authorised to issue coins of silver, nickel, and bronze of the same denominations as the British coins already in circulation – however, the Irish silver coins were to contain 75% silver as compared to the 50% silver coins issued by Britain at the time. These coins entered circulation on 12 December 1928.

Under the terms of the Currency Act 1927, a new unit of currency, the Saorstát Pound (Free State Pound) was created, which was to be maintained at parity with the British Pound Sterling by a Currency Commission which would keep British government securities, Pounds Sterling cash, and gold to keep a 1–1 relationship.

From 1928 to 1979, the UK and Ireland were in a de facto currency union.

The Central Bank Act 1942 which came into effect on 1 February 1943 renamed the Currency Commission the Central Bank of Ireland, although the organisation did not at that time acquire many of the characteristics of a central bank:

- it was not given custody of the cash reserves of the commercial banks

- it had no statutory power to restrict credit, though it could promote it

- the Bank of Ireland remained the government's banker

- the conditions for influencing credit through open-market operations did not yet exist

- Ireland's external monetary reserves were largely held as external assets of the commercial banks

The Central Bank broadened its activities over the decades, but it remained in effect a currency board until the 1970s.

In April 1978, the European Council meeting in Copenhagen decided to create a "zone of monetary stability" in Europe, and European Economic Community institutions were invited to consider how to create such a zone. At the following Council meeting in Bremen, Germany in June 1978 the basic features of the European Monetary System were outlined, including the creation of the ECU – European Currency Unit, a basket of the Community's currencies used to determine exchange rates, and the forerunner of the Euro.

On 15 December 1978, it was announced that Ireland would participate in the EMS. The EMS started on 13 March 1979, and towards the end of the month the Pound Sterling started to gain in value against the EMS currencies because of rising oil prices, and by 30 March the Pound Sterling breached the upper fluctuation band limit of the Belgian franc and the Irish currency could no longer track the Pound Sterling. After over 50 years, the parity of the Irish and British currencies was broken, and the Irish currency became known as the Irish pound (or Punt in the Irish language).

The initial experience of the EMS was disappointing. It had been expected that the Irish Pound would appreciate in value against the Pound Sterling, and hence reduce inflation in Ireland, but in practice, Sterling appreciated considerably in value thanks to its status as a petrocurrency and to the tight monetary policies of the new British government of Margaret Thatcher. By late 1980 the Irish Pound had fallen in value to less than 80 British pence, and Irish inflation was higher than British.

Eventually, the EMS settled down (notwithstanding a crisis in 1992 when the Irish Pound was devalued by 10%), and Irish inflation was the same or lower than Britain's inflation rate from 1987 onwards.

Towards the Euro

The idea of a single European currency goes back to the Schumann Plan of 1950. The first blueprint for how to go about implementing the currency, the Werner Report of 1970 was not proceeded with, but the ultimate aim was always kept in mind. The Delors Report endorsed by the Madrid Summit of June 1989 envisaged a three-stage process to monetary union, and this was given legal authority by the Maastricht Treaty of 1992 (enacted into Irish law as the Eleventh Amendment to the Constitution of Ireland by 70% of those voting in a referendum on 18 June 1992). This envisaged the start of monetary union on 1 January 1999 and the introduction of notes and coins on 1 January 2002.

The Central Bank began production of euro coins in September 1999 in the Currency Centre (Irish Mint) in Sandyford, producing over a billion coins, weighing about 5,000 tons, with a value of €230 million before the introduction into circulation of the euro coins in January 2002. Production of euro banknotes began in June 2000, with 300 million notes worth €4 billion being produced in denominations of 5, 10, 20, 50, and 100 euros. Euro banknotes produced for the Central Bank are identified by having the serial number beginning with the letter T. The Bank did not initially issue €200 or €500 notes but has since begun to do so.

Responsibilities

The Central Bank of Ireland's mandate calls on it to contribute to the well-being of the people of Ireland and more widely in Europe by performing statutory responsibilities which cover a wide range, including :

- price stability;

- financial stability;

- consumer protection;

- supervision and enforcement;

- regulatory policy development;

- payment, settlement and currency systems operations and oversight;

- the provision of economic advice and financial statistics; and

- the recovery and resolution of distressed financial services firms.

Governors

The Governor of the Bank is appointed by the President of Ireland on the constitutional advice of the Government of Ireland.

| Name (Birth–Death) |

Term of office |

|---|---|

| Joseph Brennan (1887–1963) |

1943–1953 |

| James J. McElligott (1890–1974) |

1953–1960 |

| Maurice Moynihan (1902–1999) |

1960–1969 |

| T. K. Whitaker (1916–2017) |

1969–1976 |

| Charles Henry Murray (1917–2008) |

1976–1981 |

| Tomás F. Ó Cofaigh (1921–2015) |

1981–1987 |

| Maurice F. Doyle (1932–2009) |

1987–1994 |

| Maurice O'Connell (1936–2019) |

1994–2002 |

| John Hurley (1945 – ) |

2002–2009 |

| Patrick Honohan (1949 – ) |

2009–2015 |

| Philip R. Lane (1969 – ) |

2015–2019 |

| Gabriel Makhlouf (1960 – ) |

2019–Present |

Images for kids

-

In 2016, former Irish Finance Minister Michael Noonan, told an Irish MEP to "put on the green jersey" when told of a new Irish corporate BEPS tax tool to replace the prohibited “Double Irish" tool.

See also

In Spanish: Banco Central de Irlanda para niños

In Spanish: Banco Central de Irlanda para niños

- Banknotes of the Republic of Ireland

- Coins of Ireland

- Economy of the Republic of Ireland

- Irish pound

- Irish modified GNI (or GNI star)

- Irish Fiscal Advisory Council

- Green Jersey Agenda

- Ireland as a tax haven

- List of central banks