Bernard Madoff facts for kids

Quick facts for kids

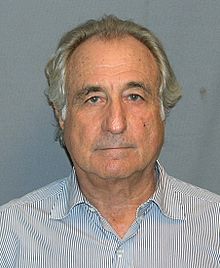

Bernie Madoff

|

|

|---|---|

US Department of Justice photograph (2009)

|

|

| Born |

Bernard Lawrence Madoff

April 29, 1938 |

| Died | April 14, 2021 (aged 82) |

| Nationality | American |

| Education | Hofstra University (1960) |

| Occupation | Former non-executive chairman of the NASDAQ |

| Employer | Bernard L. Madoff Investment Securities |

| Known for | Ponzi scheme, Chairman of NASDAQ (prior) |

| Criminal charge(s) | Securities fraud, investment advisor fraud, mail fraud, wire fraud, money laundering, false statements, perjury, making false filings with the SEC, theft from an employee benefit plan |

| Criminal penalty | 150 years imprisonment and forfeiture of US$17.179 billion |

| Spouse(s) | Ruth Madoff (m. 1959–2021) |

| Children | Mark (1964–2010) Andrew (1966-2014) |

| Parent(s) | Ralph (deceased) Sylvia (deceased) |

Bernard Lawrence "Bernie" Madoff (April 29, 1938 - April 14, 2021) was an American former investor, former stockbroker and former non-executive chairman for NASDAQ Stock Market. He was the admitted operator of a Ponzi scheme which is the largest financial fraud in United States history.

Contents

Career

In 1960, Madoff founded Bernard L. Madoff Investment Securities LLC as a broker-dealer for penny stock with $5,000 (equivalent to $49,000 in 2022) that he earned from working as a lifeguard and irrigation sprinkler installer, and a loan of $50,000 from his father-in-law, accountant Saul Alpern, who referred a circle of friends and their families. Carl J. Shapiro was one such early customer, investing $100,000. Initially, the firm made markets (quoted bid and ask prices) via the National Quotation Bureau's Pink Sheets. In order to compete with firms that were members of the New York Stock Exchange trading on the stock exchange's floor, his firm began using innovative computer information technology to disseminate its quotes. After a trial run, the technology that the firm helped to develop became the National Association of Securities Dealers Automated Quotations Stock Market (Nasdaq). After 41 years as a sole proprietorship, the Madoff firm incorporated in 2001 as a limited liability company with Madoff as the sole shareholder.

The firm functioned as a third market trading provider, bypassing exchange specialist firms by directly executing orders over the counter from retail brokers. At one point, Madoff Securities was the largest market maker at the Nasdaq, and in 2008 was the sixth-largest market maker in S&P 500 stocks. The firm also had an investment management and advisory division, which it did not publicize, that was the focus of the fraud investigation.

In March 2009, Madoff pleaded guilty to 11 federal felonies and admitted to turning his wealth management business into a massive Ponzi scheme. Thousands of investors lost billions of dollars. Madoff said he began the Ponzi scheme in the early 1990s. However, federal investigators believe the fraud began as early as the 1970s. The people who are hunting for the missing money believe the investment operation may never have been legitimate. The amount missing from client accounts, including fabricated gains, was almost $65 billion. The court-appointed trustee estimated actual losses to investors of $18 billion. On June 29, 2009, he was sentenced to 150 years in prison, the maximum allowed.

Ponzi scheme

Madoff stated he began his Ponzi scheme in 1991. He admitted he had never made any legitimate investments with his clients' money during this time. Instead, he said, he simply deposited the money into his personal business account at Chase Manhattan Bank. When his customers asked for withdrawals, he paid them out of the Chase account—a classic "robbing Peter to pay Paul" scenario. Chase and its successor, JPMorgan Chase, may have earned as much as $483 million from his bank account. He was committed to satisfying his clients' expectations of high returns, despite an economic recession. He admitted to false trading activities masked by foreign transfers and false SEC filings. He stated that he always intended to resume legitimate trading activity, but it proved "difficult, and ultimately impossible" to reconcile his client accounts. In the end, he said, he realized that his scam would eventually be exposed.

Personal life

Madoff is of Jewish descent. He was married to Ruth. The elder of their two sons died in 2010. The younger son died in 2014. In December 2013, Madoff suffered from a heart attack. In January 2014, he had stage 4 kidney cancer.

Death

Madoff died on April 14, 2021, at the age of 82.

See also

In Spanish: Bernard Madoff para niños

In Spanish: Bernard Madoff para niños